INTRODUCING

Digital Precious Metals

PRODUCT DESCRIPTION

What are Digital Precious Metals

Digital Precious Metals are a simple and cost effective way to buy, manage and sell investment grade physical bullion in fractional and affordable quantities as small as 1 gram. Benefit from economies of scale inherent in partial ownership of institutional investment grade LBMA approved bars.

Buying gold coins and small bars offers a popular but costly way of doing so, however the price to buy or sell is typically 5 – 8% higher or lower respectively than the spot price of gold. Additionally, you also need to consider the cost of delivery and home insurance.

Buying Digital Precious Metals, securely stored and insured in an institutional grade vault(s) through Goldwise, avoids nearly all these costs.

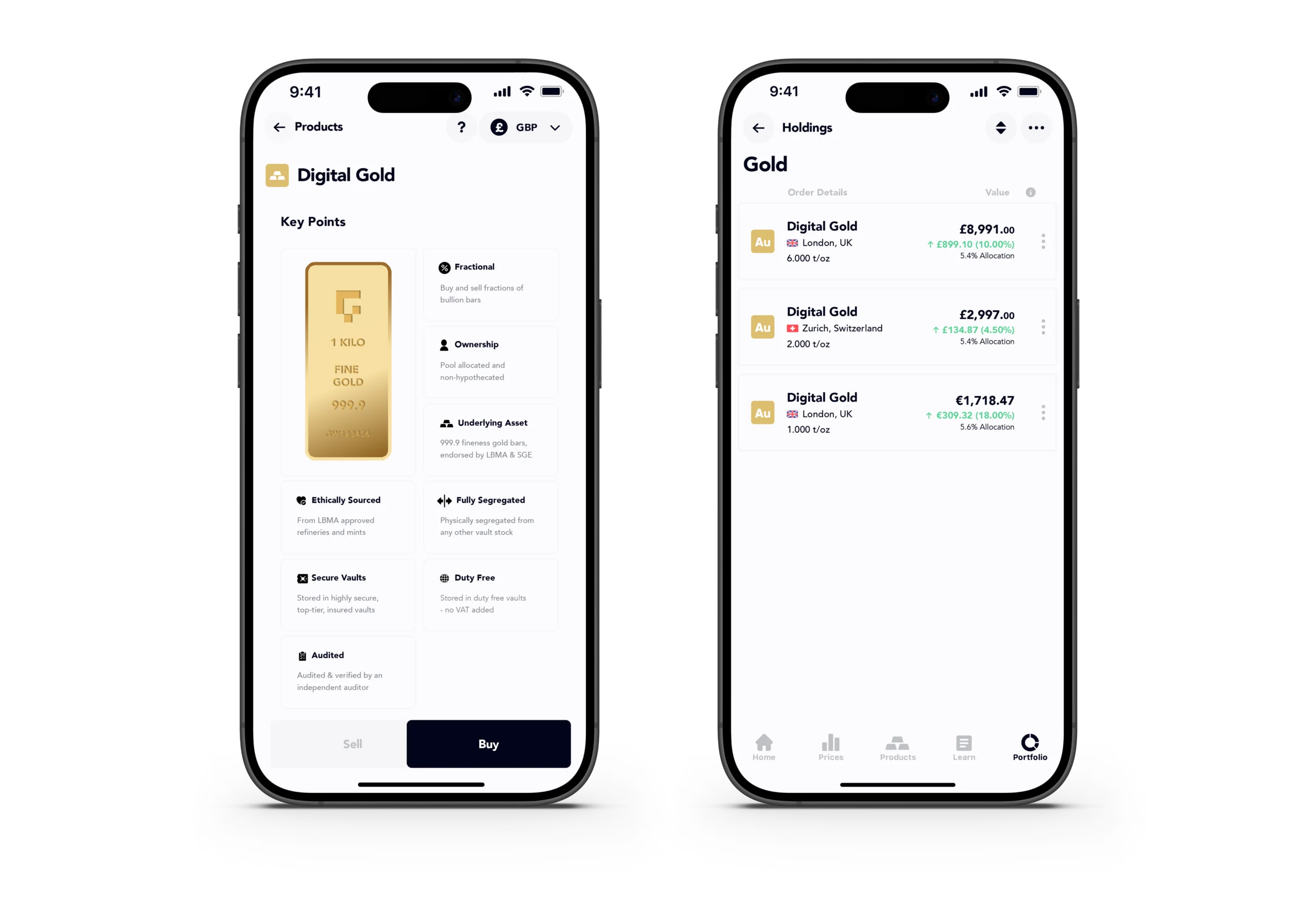

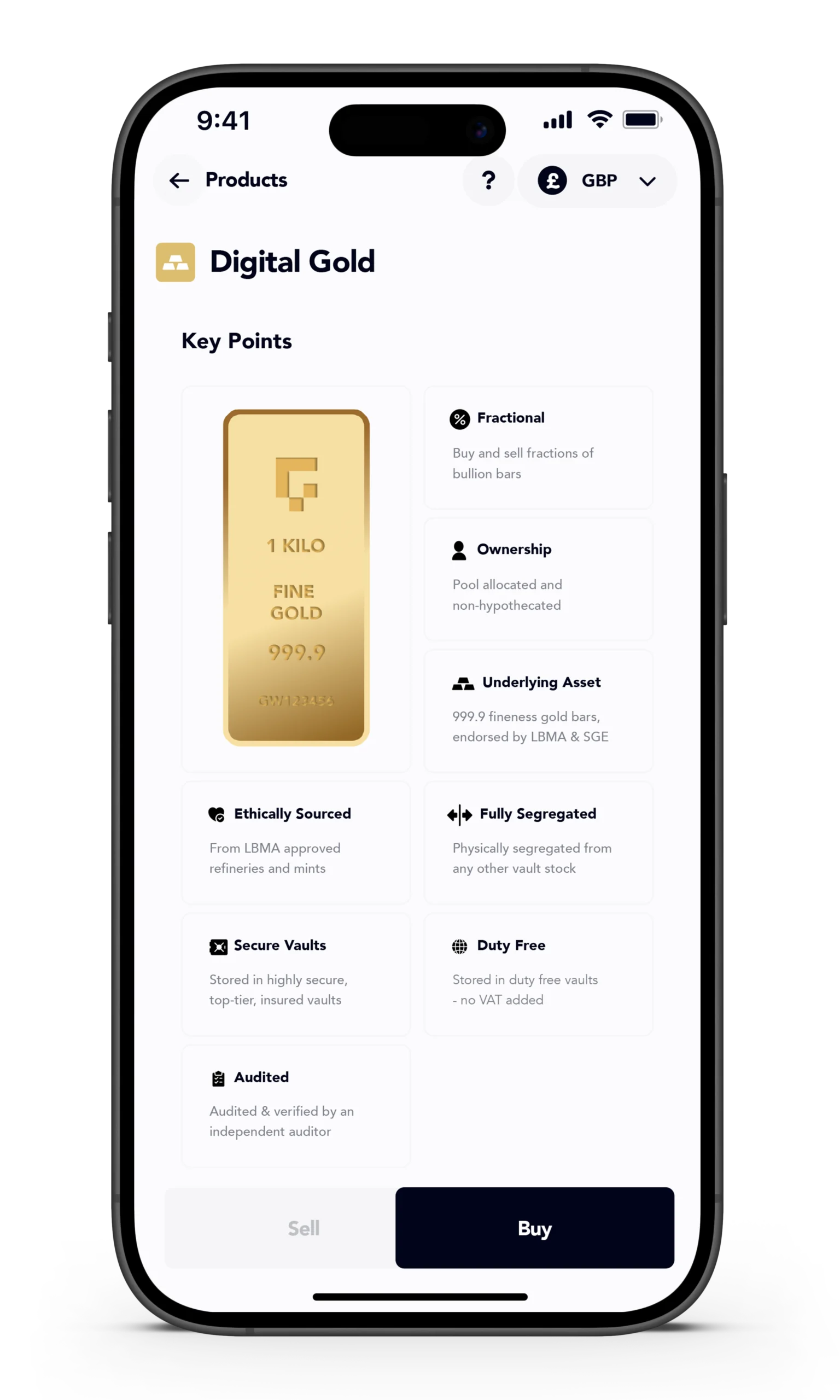

KEY POINTS

What am I getting

Fractional

Buy & Sell fractional amounts of bullion bars

Ownership

Pool allocated & non-hypothecated with title ownership

Physcially Backed

Investment grade bullion bars endorsed by the LBMA & SGE

Ethically Sourced

Buy & Sell fractional amounts of bullion bars

Fully Segregated

Physically segregated from any other Vault stock

Secure Vaults

Stored in highly secure, top-tier, insured vaults

Duty Free

Stored in duty free Vaults, no VAT added

Audited

Audited & verified by an independent auditor

HOW IT WORKS

5 Easy Steps

We’ve made the process of Buying, Managing & Selling Digital Precious Metals quick, easy and intuitive

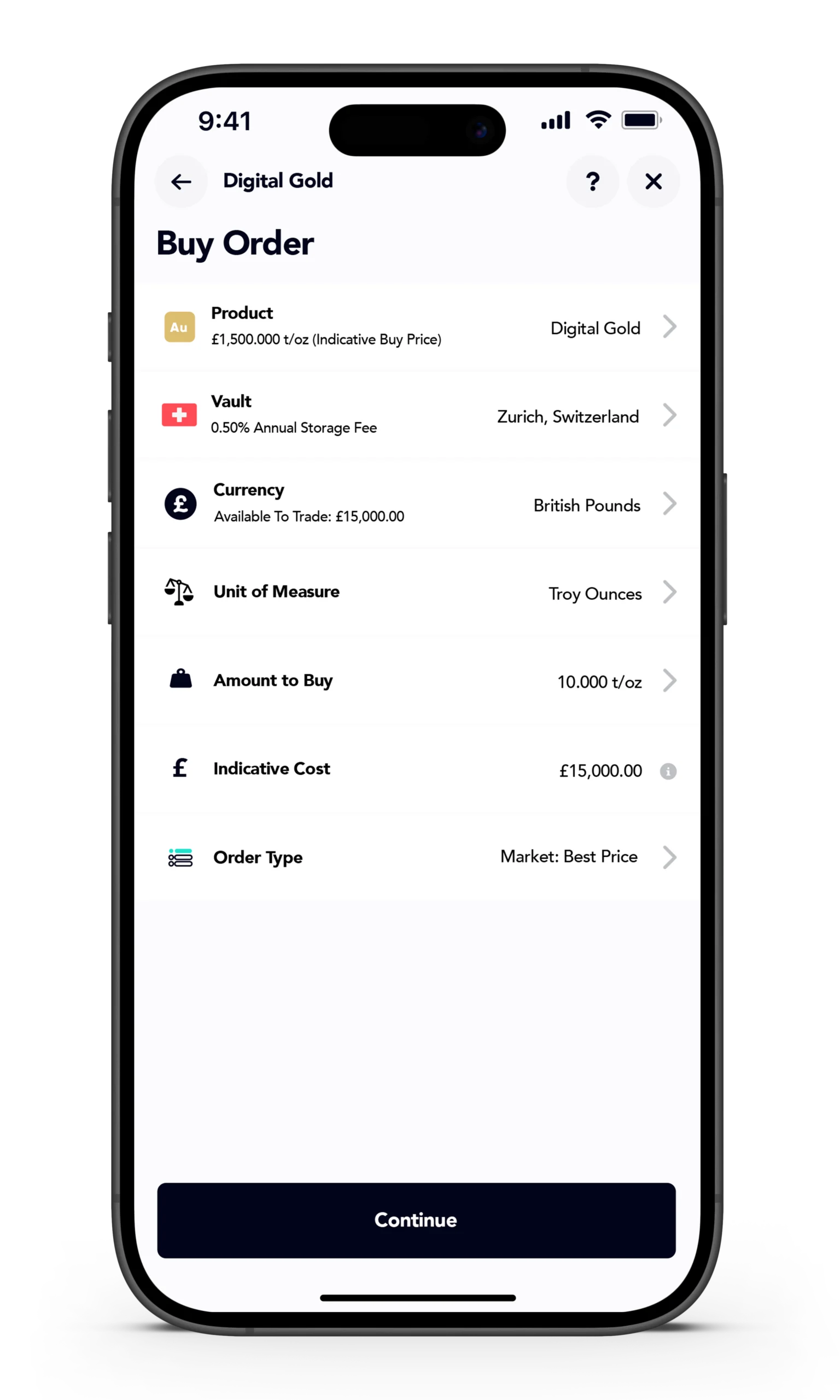

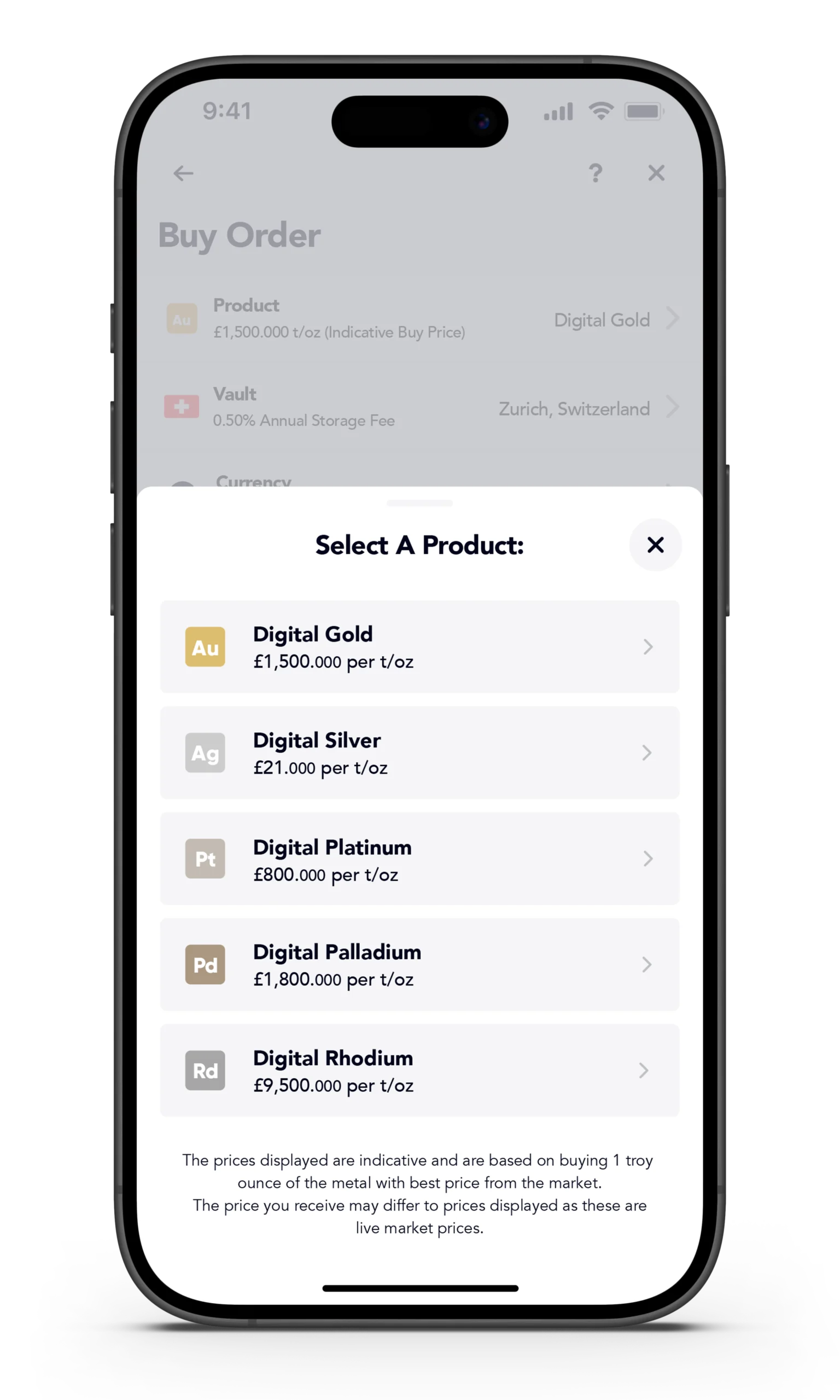

Select a Precious Metal

Having funded your account and started a Buy order, the first step is selecting the Digital Precious Metal you want to trade

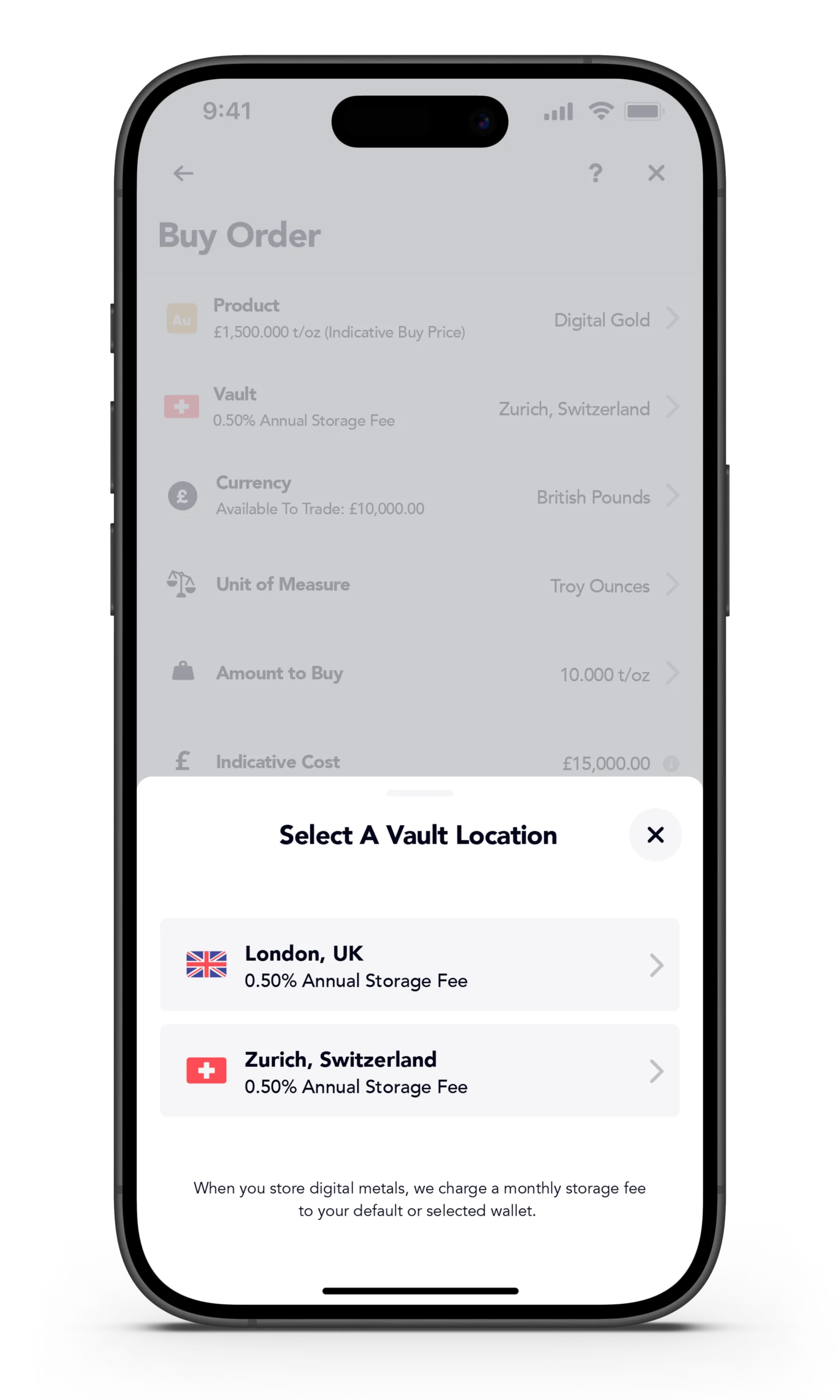

Select a Vault Location

Next, select which Vault location you want to store your precious metals in from our list of institutional vault partner locations

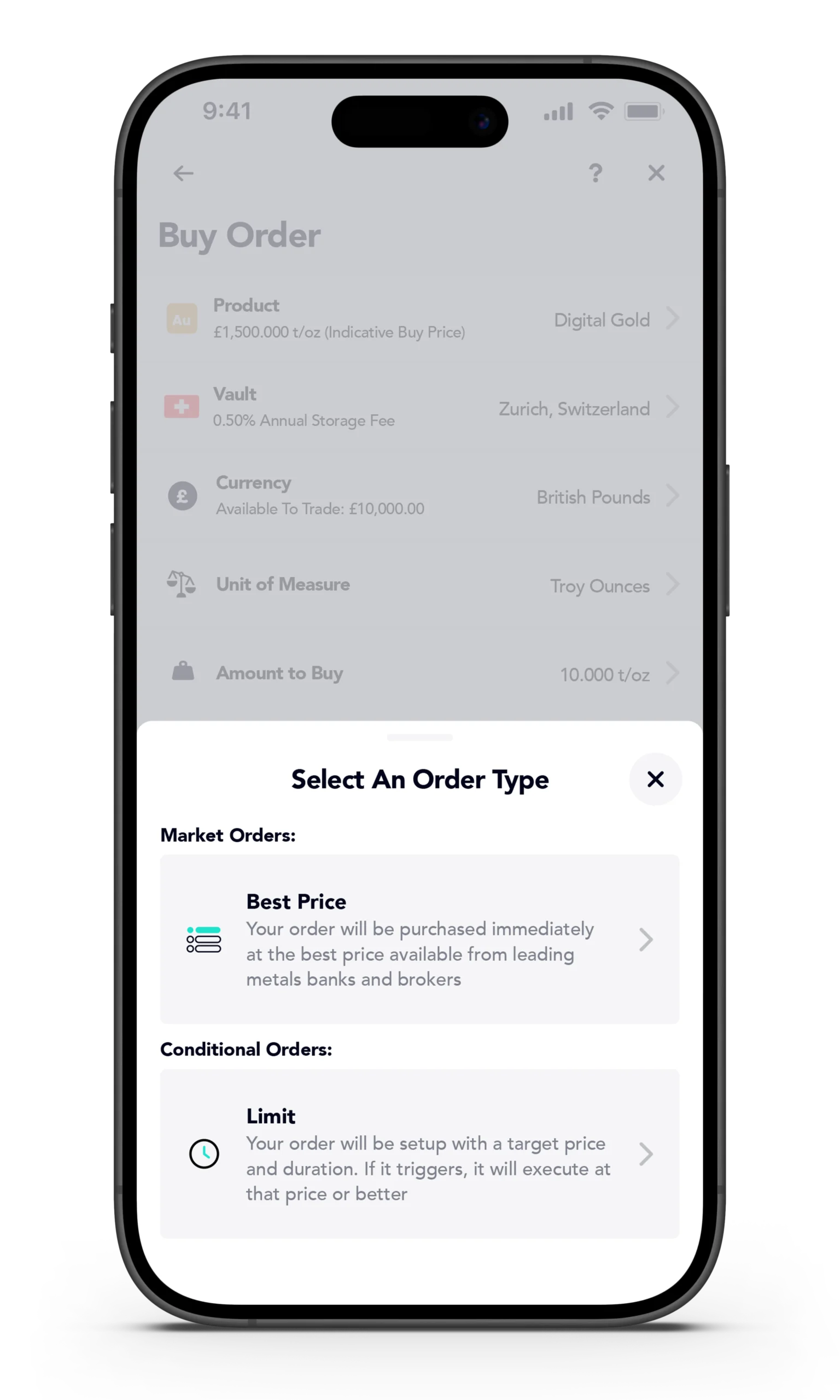

Enter your Order Criteria

Then, select the Currency to trade in, the Unit of Measure to use, the Amount to Buy or Sell and, the Order Type to use, choosing either to Buy now with Best Price or at a defined price with Conditional orders

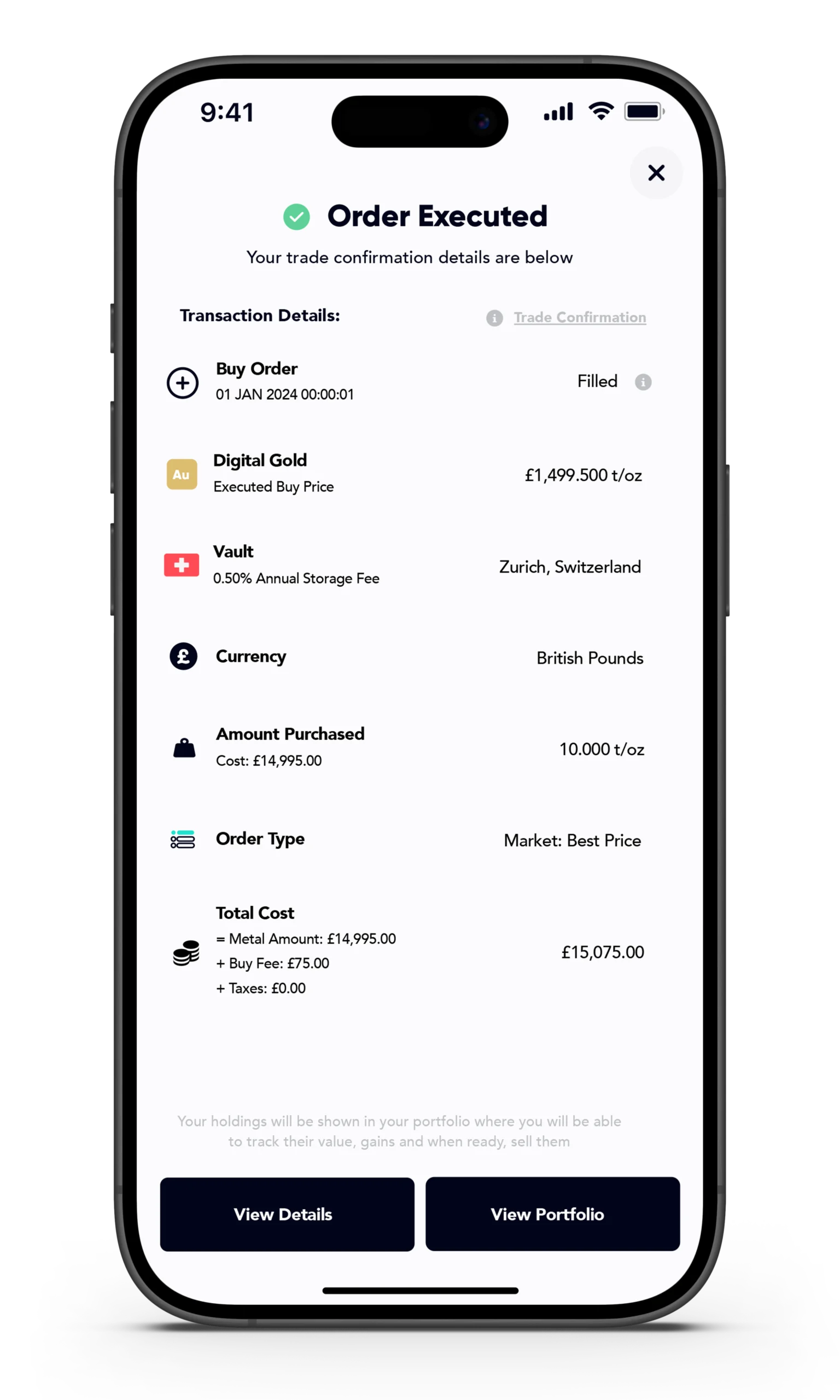

Review & Execute your Order

Review your Order details and costs and when ready, execute your order. Your Order will be Filled by the market based on your Order type & conditions

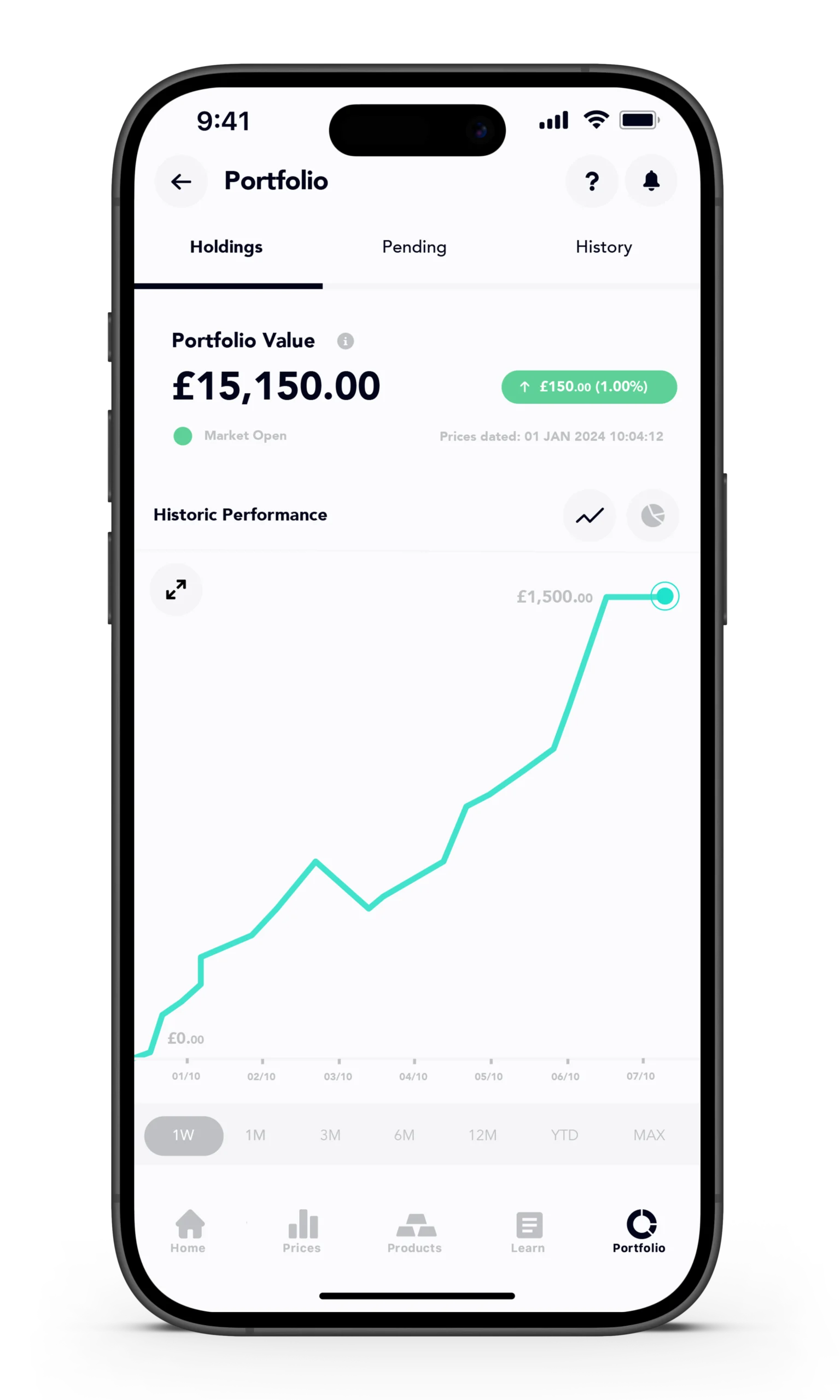

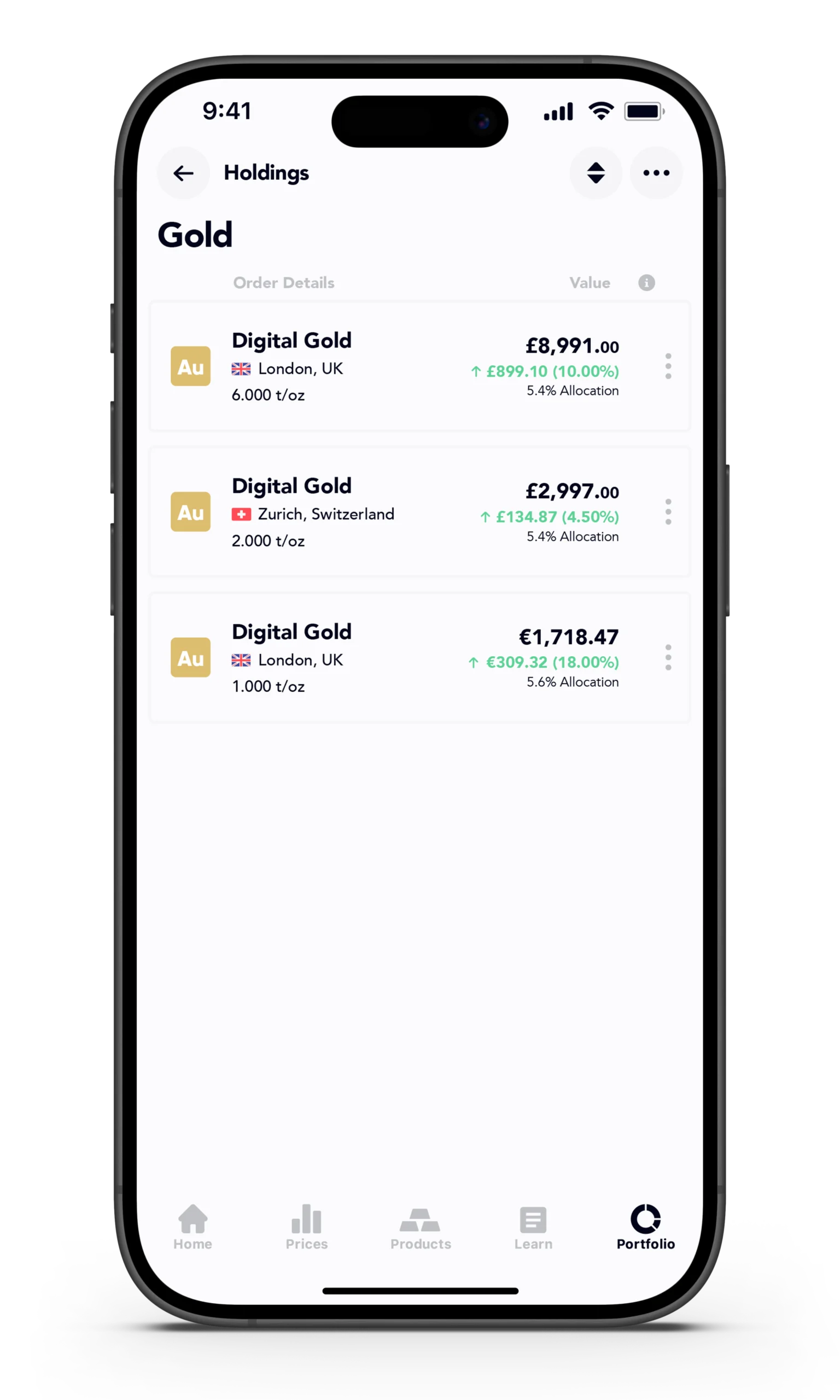

Manage your Portfolio & Sell

You'll finally be able to Track the real-time valuation and gains of your Order & Portfolio and when ready, choose to either sell immediately with Best price or on your conditions

TYPICAL FEES

Trading & Vaulting Fees

Below are the fees you would be charged if you were Buying & Vaulting Digital Gold in London.

Fees may differ by Metal & Vault location, see our Fees Page for detailed information

Buy Fee

0.50%

Per Buy transaction

Based on the Precious Metal amount being bought

Vaulting Fee

0.15%

Annual Fee, Charged Monthly

Based on the average daily market value of your holdings per vault. Minimum fees apply

Sell Fee

0.50%

Per Sell transaction

Based on the Precious Metal amount being sold

Example: Based on the information above with no change to the investment valuation, an investment of £10,000 of Digital Gold stored in London, you would pay a Buy transaction fee of £50, a Vaulting fee per year of £15 (£1.25 per month) and a Selling transaction fee of £50 when you sold.

PRODUCT COMPARISON

Digital vs Bullion vs Alternatives

How do Digital Precious Metals compare against trading of physical bullion bars and coins or alternative products such as ETC/ETFs or Tokens? We compare all the options below

| Digital | Coins | Bars |

ETC/ETF (Active) |

ETC/ETF (Pasive) |

Tokens | |

|---|---|---|---|---|---|---|

|

Instrument The product and description |

Bullion Bars Investment grade |

Bullion Coins Investment grade |

Bullion Bars Investment grade |

IOU / Security 'Asset backed' |

IOU / Security 'Asset backed' |

IOU / Token 'Asset backed' |

|

Asset Backing What % of the product is backed by physical bullion |

100% |

100% |

100% |

<100% Derivatives can be up to 75% |

<100% Derivatives can be up to 25% |

<100% Derivatives can be used |

|

Transaction Fees The typical buy/sell fees added to the spot price of the metal |

0.50% |

5% - 15% |

3% - 10% |

0% - 0.75% |

£5.99 - 0.75% |

1.5% - 2.5% |

|

On-going Charges The typical annual storage or management fees |

0.15% |

0.65% - 2% |

0.65% - 2% |

0.65% - 1.25% |

0.12% - 0.95% |

0.95% - 2% |

|

Ownership Title ownership of the precious metals e.g. they're owned by you |

||||||

|

Counter-party Risks What 3rd party risks you're exposed to |

|

|

||||

|

Delivery Option The product can be delivered or converted and delivered immediately or at a future date |

||||||

The contents of the table are based on a range of sources and providers, details may vary and are for illustrative purposes only

PRODUCT RANGE

Choose a Precious Metal

Select the digital precious metal you want to learn more about from the list below