GOLDWISE CONNECT

Physical Precious Metals Trading API

for Wealth Platforms

GOLDWISE

Physical Precious Metals Trading API with 24/7 Access

GOLDWISE

Physical Precious Metals Trading API

with 24/7 Access

Provide Your Customers with the Physical Precious Metals Asset Class.

Enable your customers to trade physical Gold, Silver, Platinum & Palladium — 24/7 with our turnkey API providing live price streams, institutional order execution, configurable trading flows and physical metal allocation — delivered as a single service.

Enterprise Grade Trading Technology with Institutional Liquidity and Physical Allocation.

Dedicated & Scaleable

Environments

Segregated, Configureable & Secure with Admin Portal Access.

Live Market

Price Streams

Institutional multi-metal & multi-currency prices – streamed 24/7.

Market & Conditional

Orders

Your user flows, backed with our enterprise order management.

Physical Allocation

& Vaulting

To give Direct Ownership and low operation burden.

BEST PRICE EXECUTION

Get the Best Prices from the Institutional Market

Your customer orders are executed directly against aggregated institutional order books from global metals banks and brokers. Goldwise does not internalise flow or act as a market maker — ensuring transparent, best-available pricing on every trade.

Some of our Liquidity Providers:

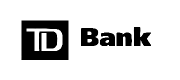

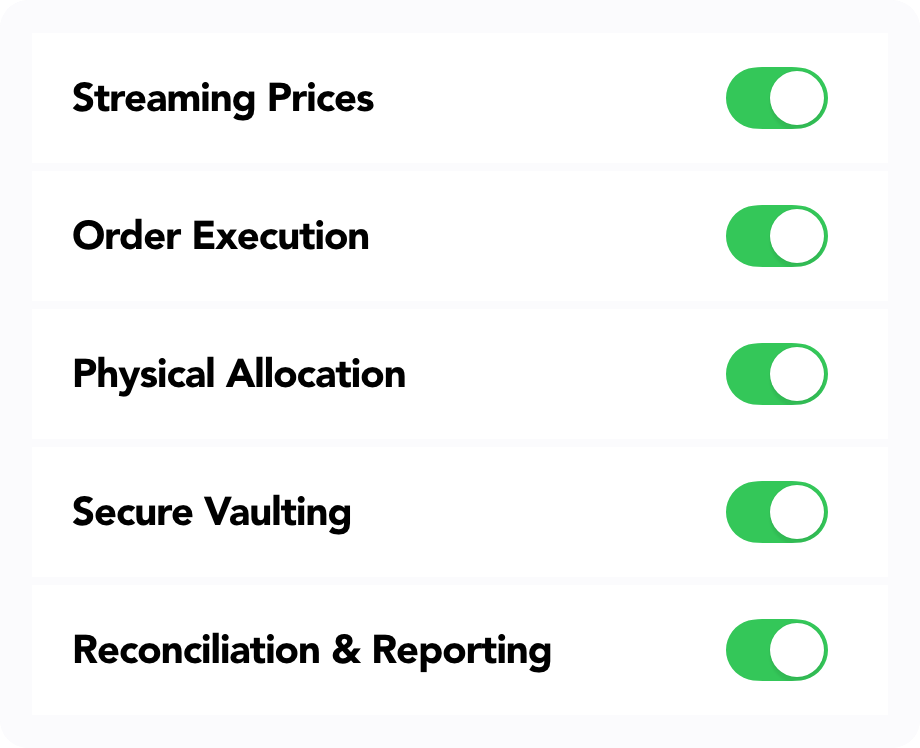

OUR SERVICE

Physical Precious Metals as-a-Service

Goldwise Connect delivers a seamless, fully managed physical precious metals trading solution tailored for wealth platforms.

- One API

- Price Stream

- Order Execution

- Physical Allocation

- Settlement & Admin

ONE API & SERVICE

Everything you need

Roll out physical precious metals as a core asset class with speed, security and institutional quality execution and operations — ditching the patchwork of vendors for a single, streamlined operating model.

- Dedicated environment & hosting - scale and customise

- Single API covering pricing, trading, custody & ops

- Access to multiple metals, currency & vaults

INSTITUTIONAL BEST-PRICES

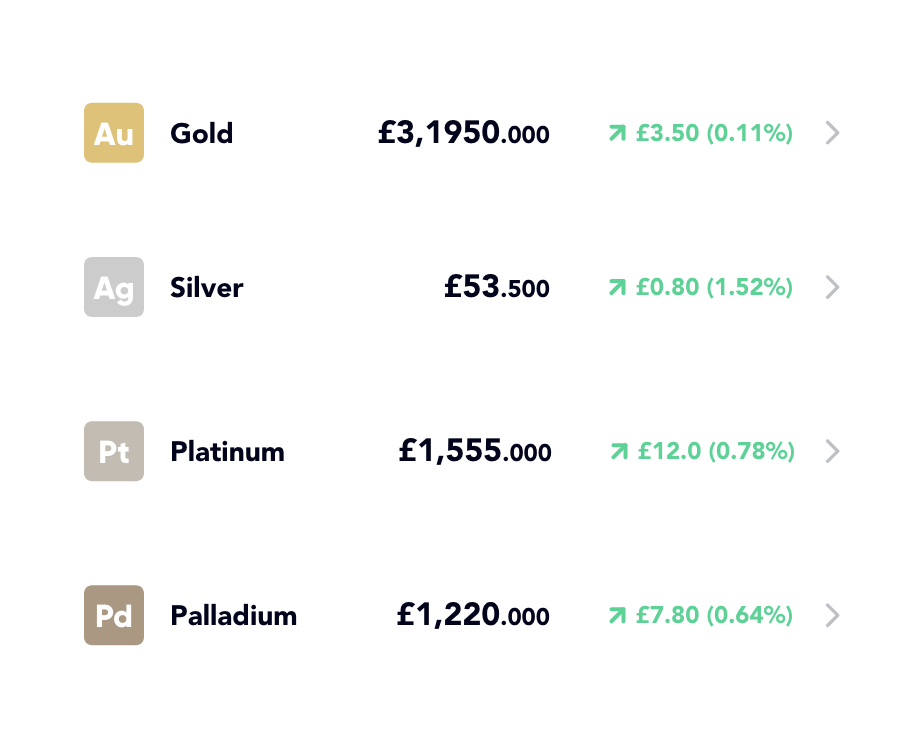

Live Price Stream

Deliver institutional-grade, real-time buy and sell quotes for gold, silver, platinum, and palladium — complete with daily change values — sourced straight from the live order books that power actual executions.

At Goldwise, what your customers view is exactly what they trade, banishing doubts and delays from outdated or disconnected spot prices for a seamless, trust-infused experience.

- Live executable prices, not indicative spot fees

- Multi-metal & currency

- Day change by amount & percentage

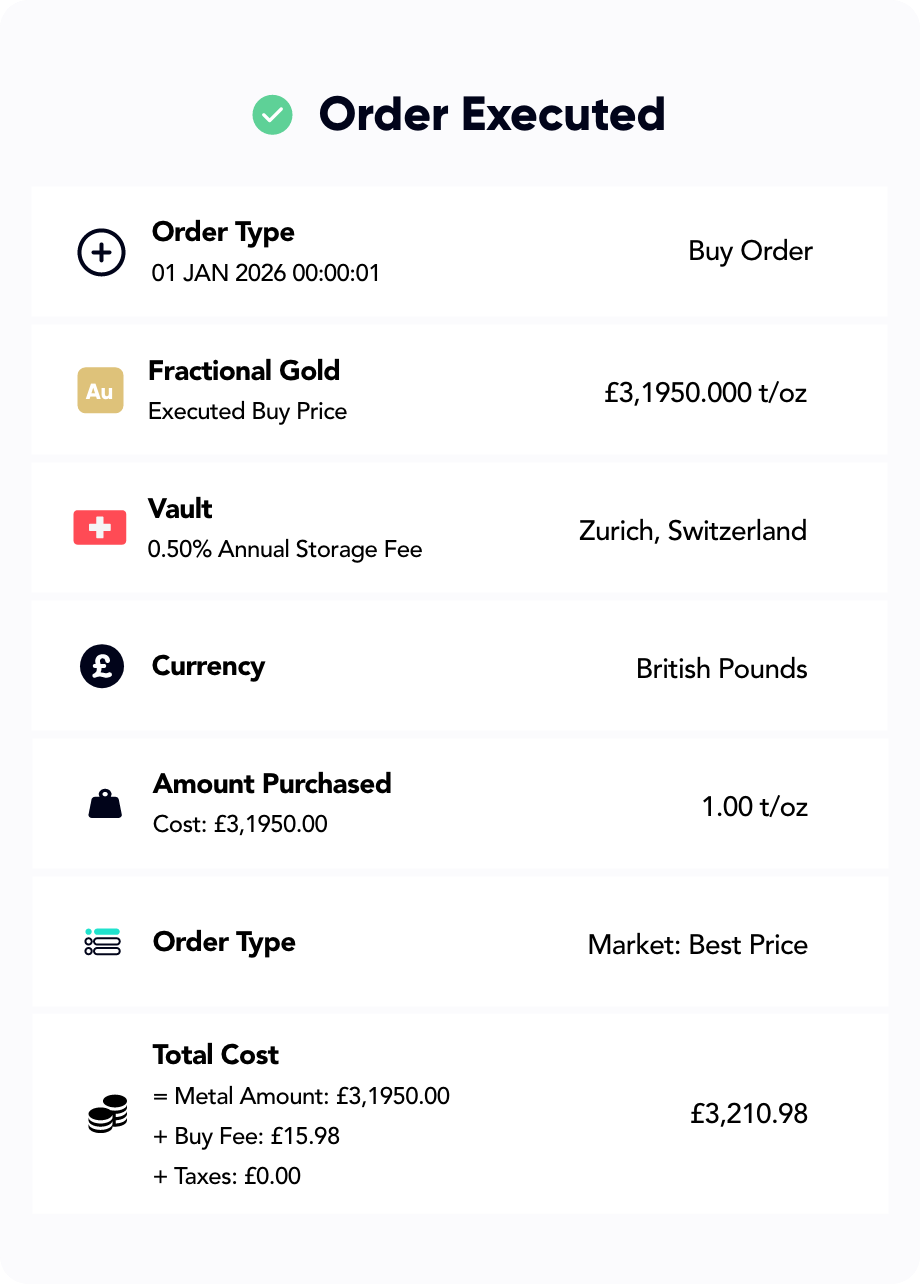

24/7 FRACTIONAL TRADING

Orders & Execution

Orders can be placed in fractional sizes down to 0.001 troy ounces (c.£5 equivalent) — for razor-sharp portfolio adjustments that democratise physical precious metals trading for beginners and pros alike.

- 24/7 execution with extended hours trading

- Market & Conditional Order Types

- Trade in 0.001 troy ounce units

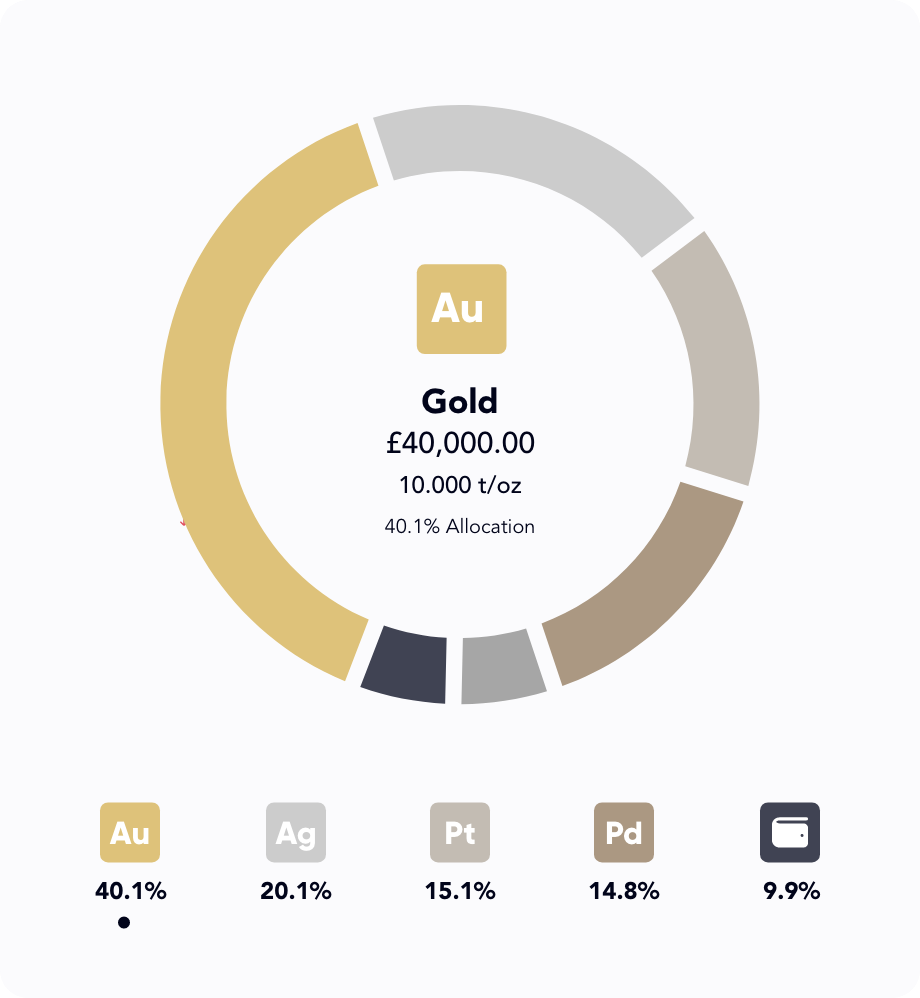

DEDICATED METAL LEDGERS

Allocated Physical Metals

Experience true physical exposure backed by clear transparency and institutional vault-custody standards — far beyond comingled pooling or paper & credit claims.

- Direct ownership of allocated physical metal

- Omnibus or per-customer metal ledgers

- LBMA approved products only

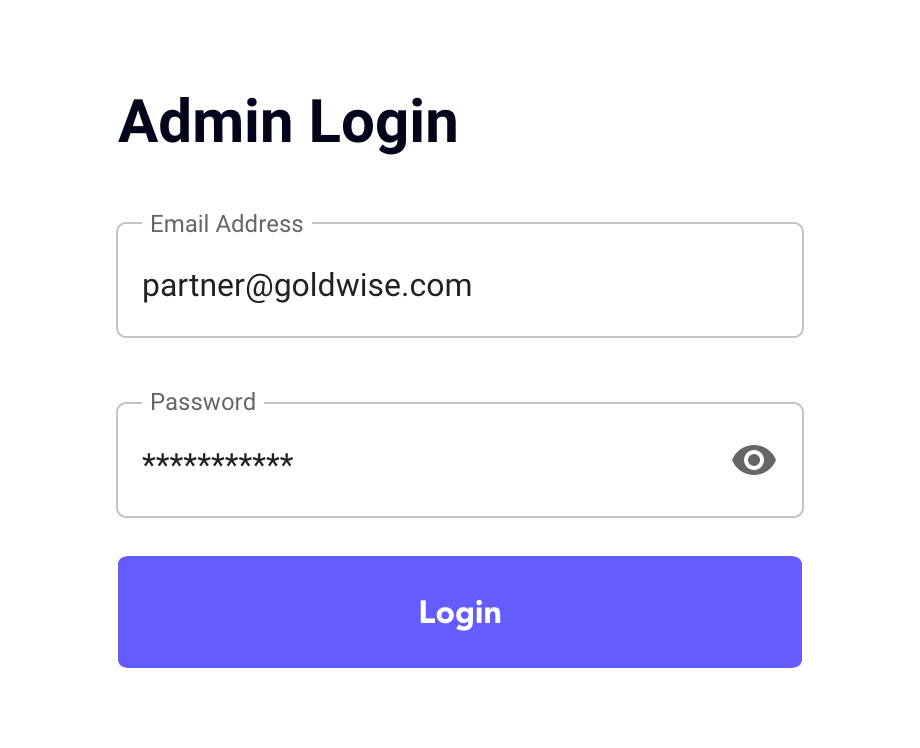

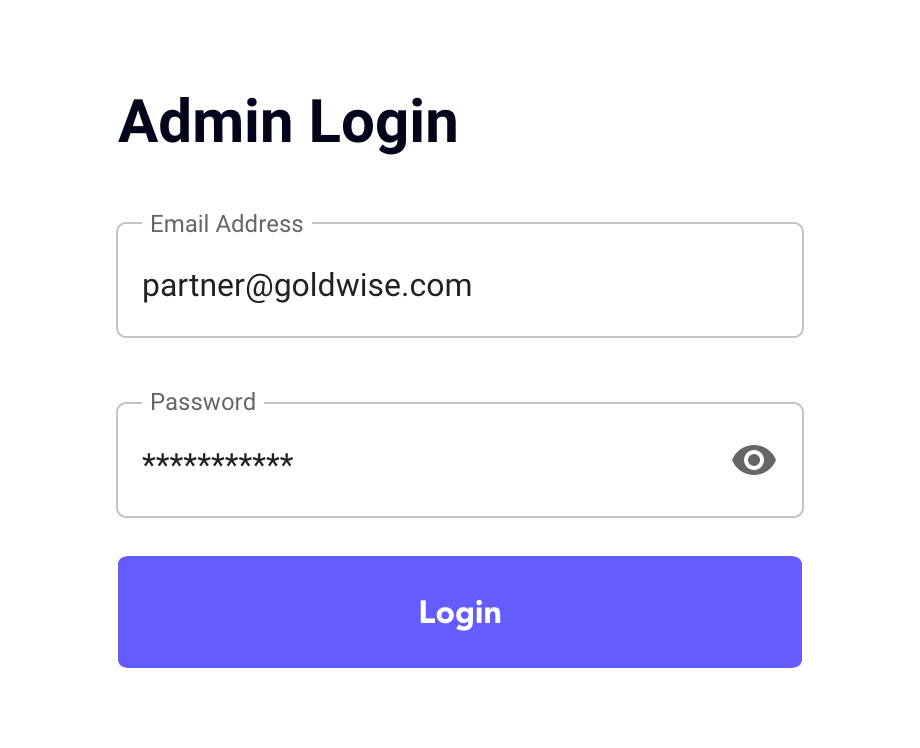

FULL CONTROL & LOW OPERATIONAL BURDEN

Daily Recon & Admin

Partners receive access to a secure admin portal for real-time oversight, robust reporting, and effortless operational control — without needing to build back-office infrastructure.

- Full visibility of Customers, Orders & Ledgers

- End-of-day Settlement & Clearing

- Admin Portal Access

ONE API & SERVICE

Everything you need

Roll out physical precious metals as a core asset class with speed, security and institutional quality execution and operations — ditching the patchwork of vendors for a single, streamlined operating model.

- Dedicated environment & hosting - scale and customise

- Single API covering pricing, trading, custody & ops

- Access to multiple metals, currency & vaults

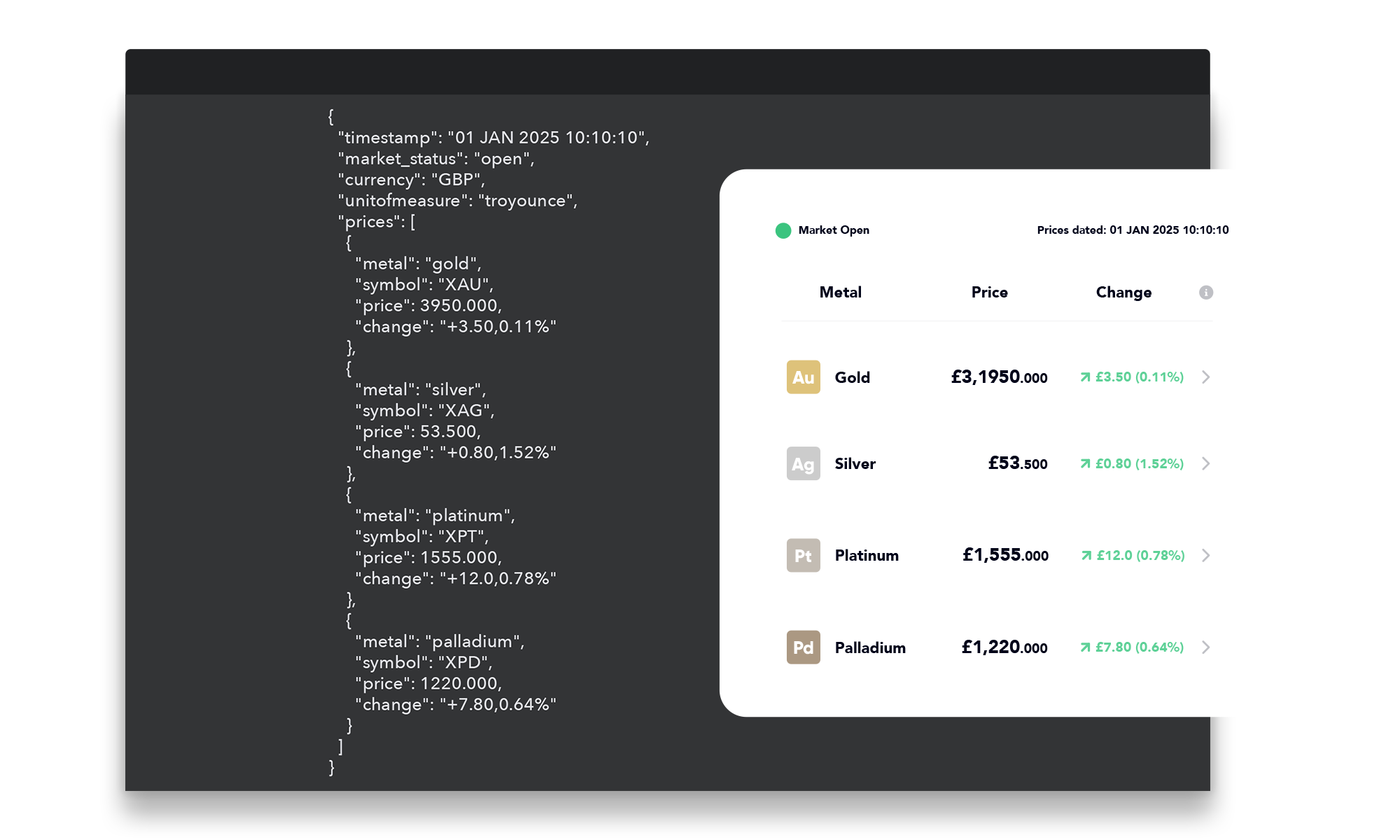

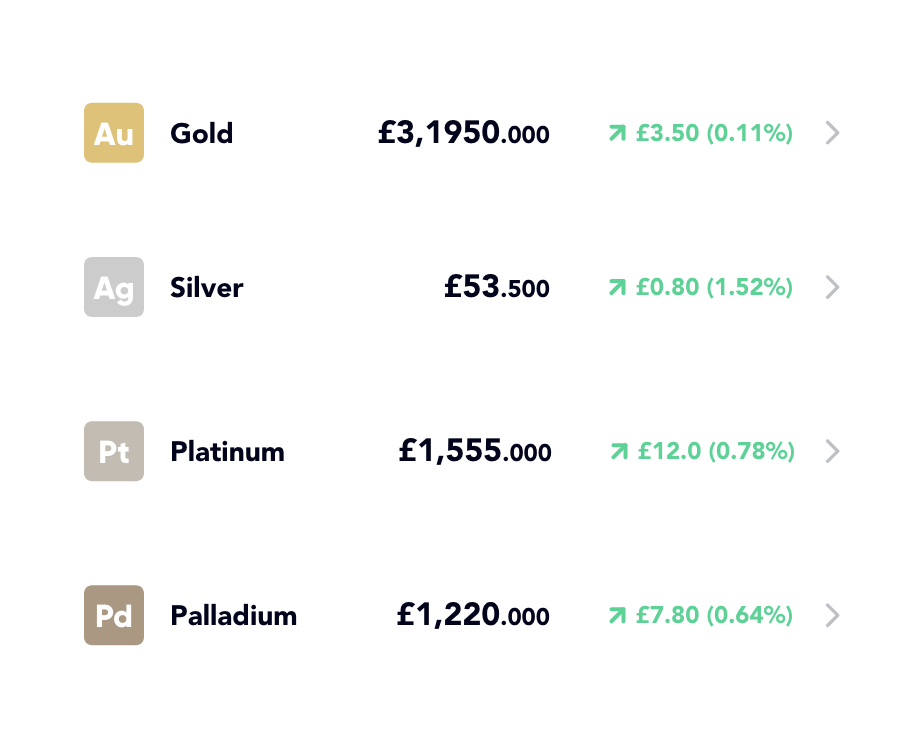

INSTITUTIONAL BEST-PRICES

Live Price Stream

Deliver institutional-grade, real-time buy and sell quotes for gold, silver, platinum, and palladium — complete with daily change values — sourced straight from the live order books that power actual executions.

At Goldwise, what your customers view is exactly what they trade, banishing doubts and delays from outdated or disconnected spot prices for a seamless, trust-infused experience.

- Live executable prices, not indicative spot fees

- Multi-metal & currency

- Day change by amount & percentage

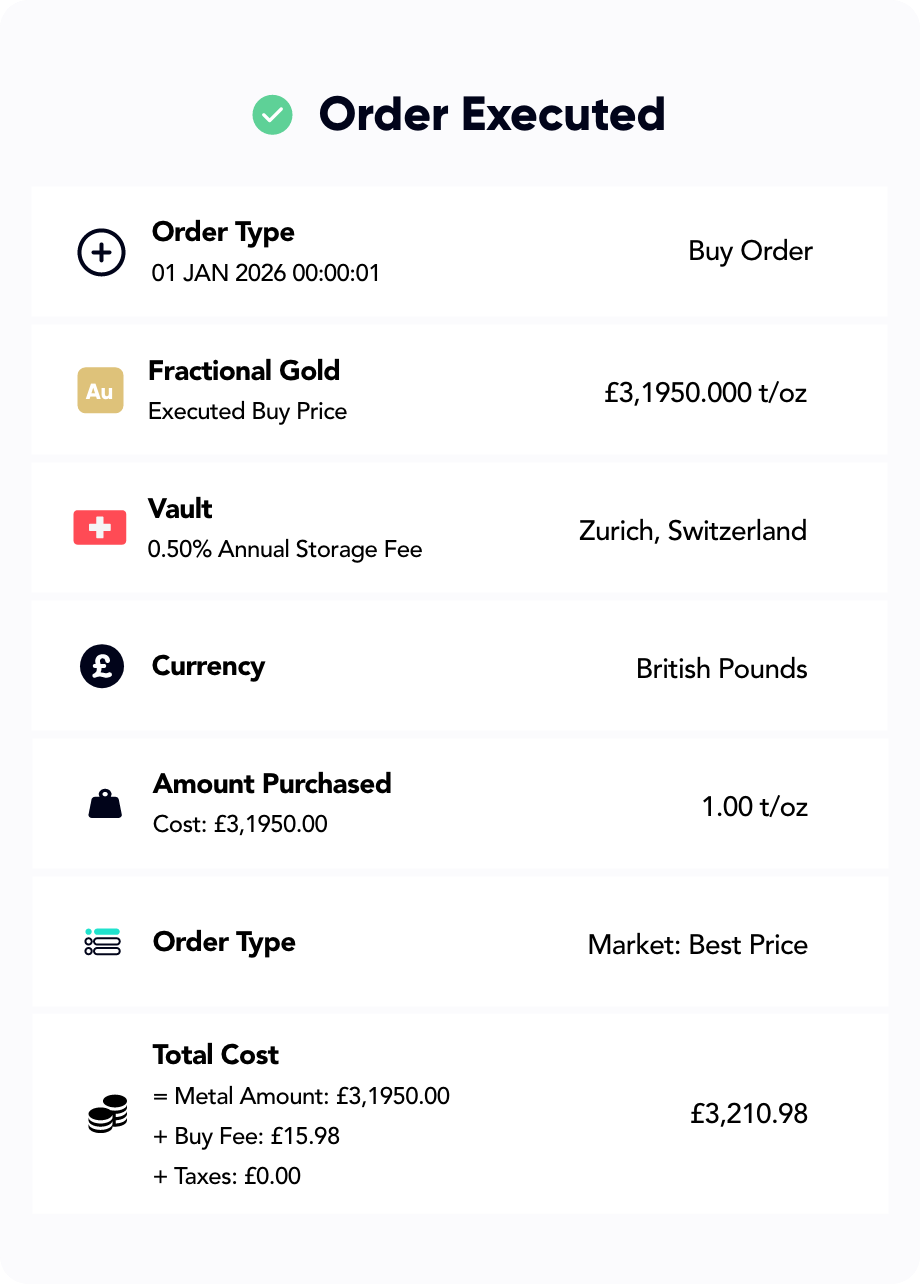

24/7 FRACTIONAL TRADING

Orders & Execution

Orders can be placed in fractional sizes down to 0.001 troy ounces (c.£5 equivalent) — for razor-sharp portfolio adjustments that democratise physical precious metals trading for beginners and pros alike.

- 24/7 execution with extended hours trading

- Market & Conditional Order Types

- Trade in 0.001 troy ounce units

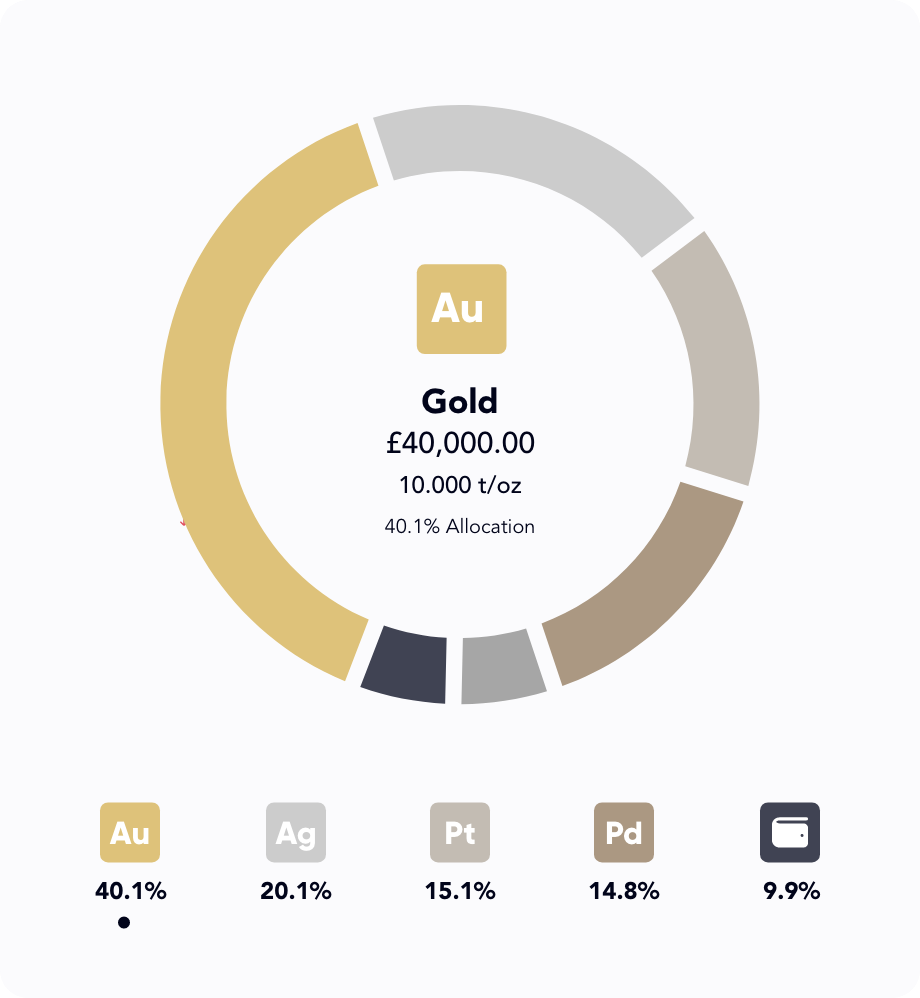

DEDICATED METAL LEDGERS

Allocated Physical Metals

Experience true physical exposure backed by clear transparency and institutional vault-custody standards — far beyond comingled pooling or paper & credit claims.

- Direct ownership of allocated physical metal

- Omnibus or per-customer metal ledgers

- LBMA approved products only

FULL CONTROL & LOW OPERATIONAL BURDEN

Daily Recon & Admin

Partners receive access to a secure admin portal for real-time oversight, robust reporting, and effortless operational control — without needing to build back-office infrastructure.

- Full visibility of Customers, Orders & Ledgers

- End-of-day Settlement & Clearing

- Admin Portal Access

Benefit From:

- New Customer Acquisition

- New Revenue Generation

- Speed to Market

- Diversification & Retention

WHO'S IT FOR

For Wealth Platforms

Goldwise Connect helps financial service companies to add the physical precious metals as a core investment option without the complexity of building and operating the infrastructure.

Available To:

Investment Platforms

Offering execution-only services – with a range of assets classes.

Banks & FinTechs

Offering retail savings, investments, payments and share dealing services.

Advisory Platforms

Offering advisory & investment services to their customers.

Financial Services Infrastructure

Offering wealth platforms & Fintech start-ups with financial services technology and solutions.

WANT TO LEARN MORE

Get in touch

Our team are always happy to discuss partnership opportunities and provide technical support.

Call Us

+44 29 2105 5383