INTRODUCING

Fractional Bullion Bars

Buy and Sell fractional amounts of ethically sourced, investment grade bullion bars, produced by LBMA approved refineries and stored with insured, 3rd party audited, top-tier institutional grade vaults.

PRODUCT DESCRIPTION

What are Fractional Bars?

Fractional Bars are a simple and cost effective way to buy, manage and sell investment grade physical bullion in fractional and affordable quantities as small as 1 gram. Benefit from economies of scale inherent in partial ownership of institutional investment grade LBMA approved bars.

Buying gold coins and small bars offers a popular but costly way of doing so, however the price to buy or sell is typically 5 – 8% higher or lower respectively than the spot price of gold. Additionally, you also need to consider the cost of delivery and home insurance.

Buying Fractional Bars, securely stored and insured in an institutional grade vault(s) with title ownership, avoids nearly all these costs.

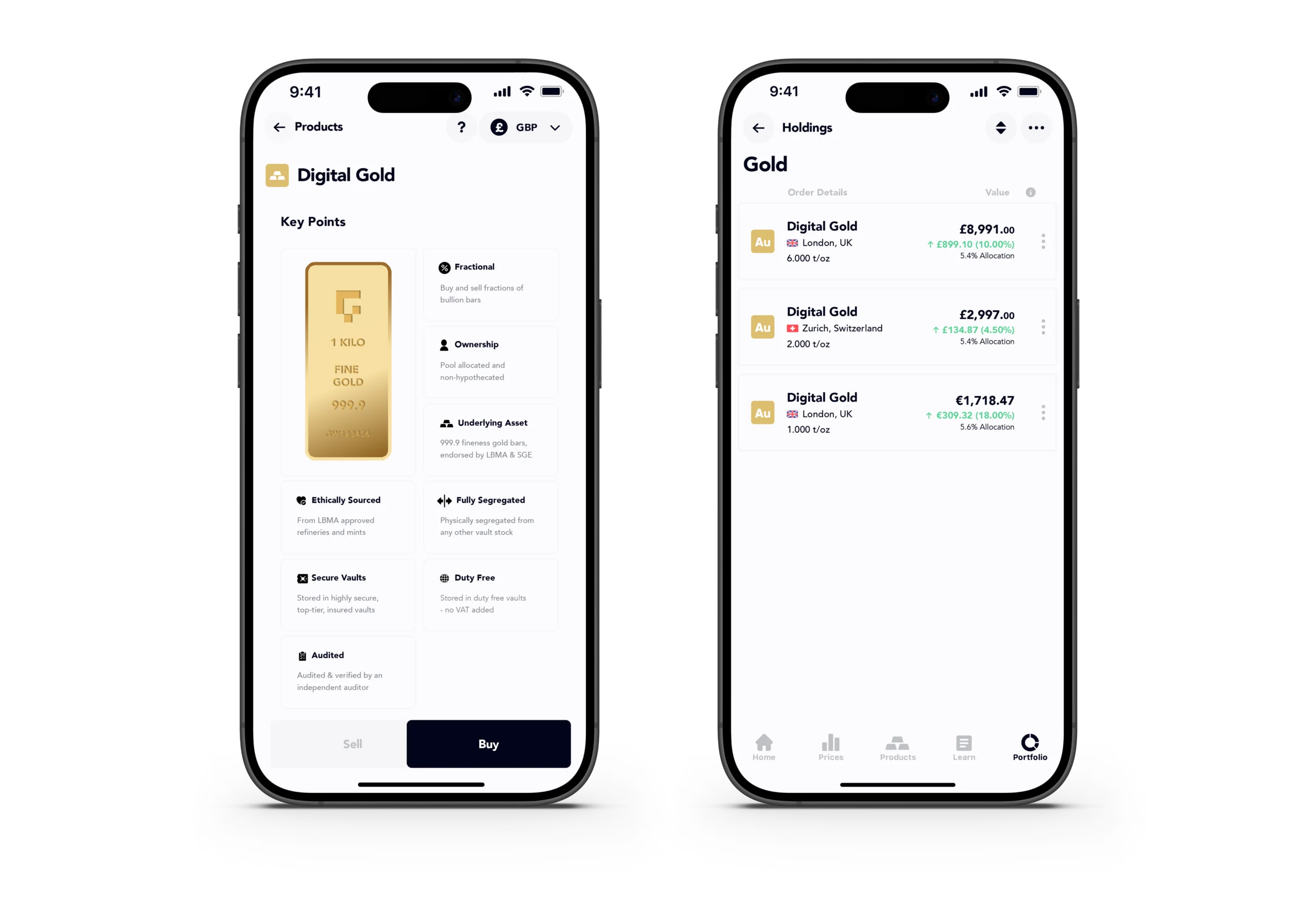

KEY POINTS

What you get

Fractional

Buy & Sell fractional amounts of bullion bars

Ownership

Pool allocated & non-hypothecated with title ownership

Physcially Backed

Investment grade bullion bars endorsed by the LBMA & SGE

Ethically Sourced

Buy & Sell fractional amounts of bullion bars

Fully Segregated

Physically segregated from any other Vault stock

Secure Vaults

Stored in highly secure, top-tier, insured vaults

Duty Free

Stored in duty free Vaults, no VAT added

Audited

Audited & verified by an independent auditor

HOW IT WORKS

5 Easy Steps

We’ve made the process of Buying, Managing & Selling

Quick, Easy and Intuitive

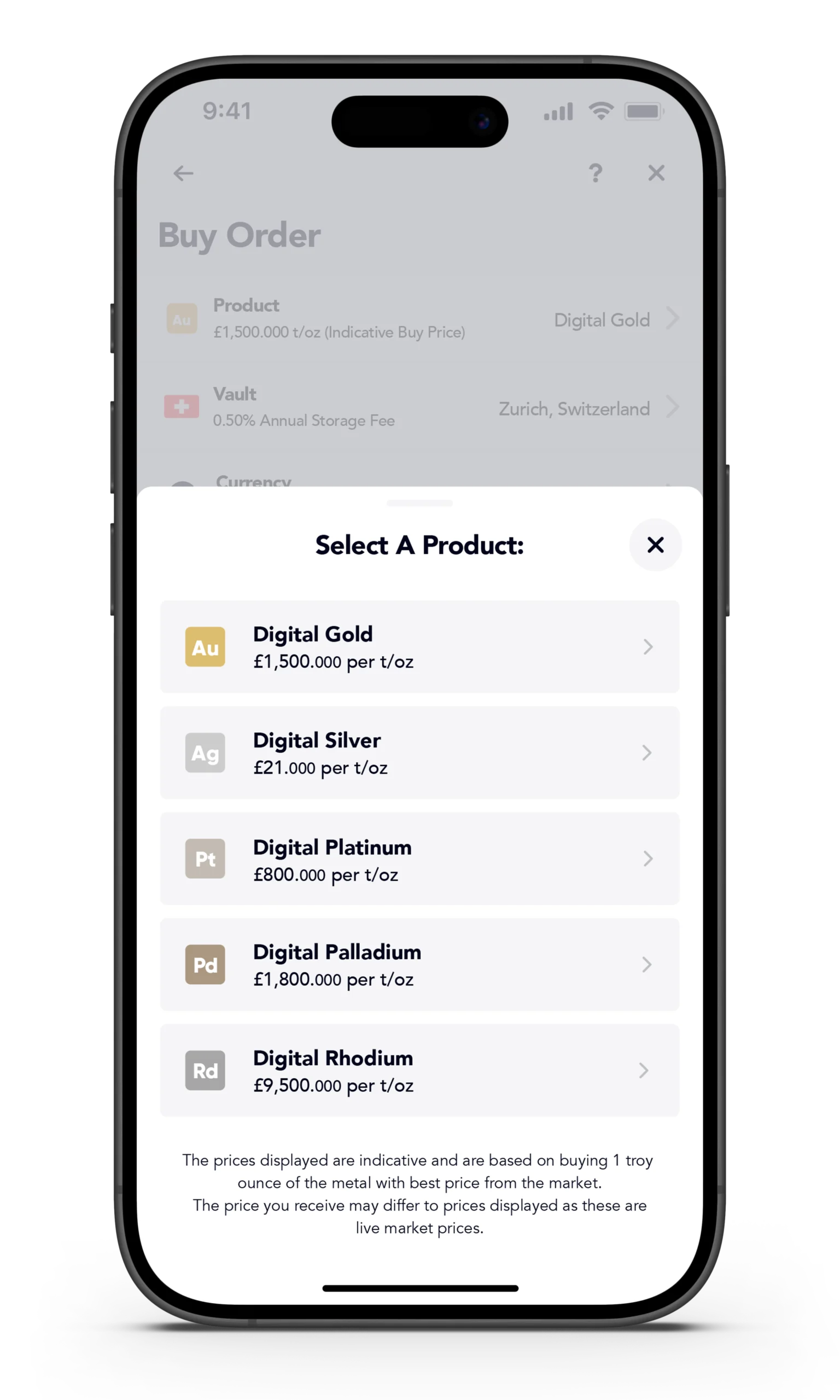

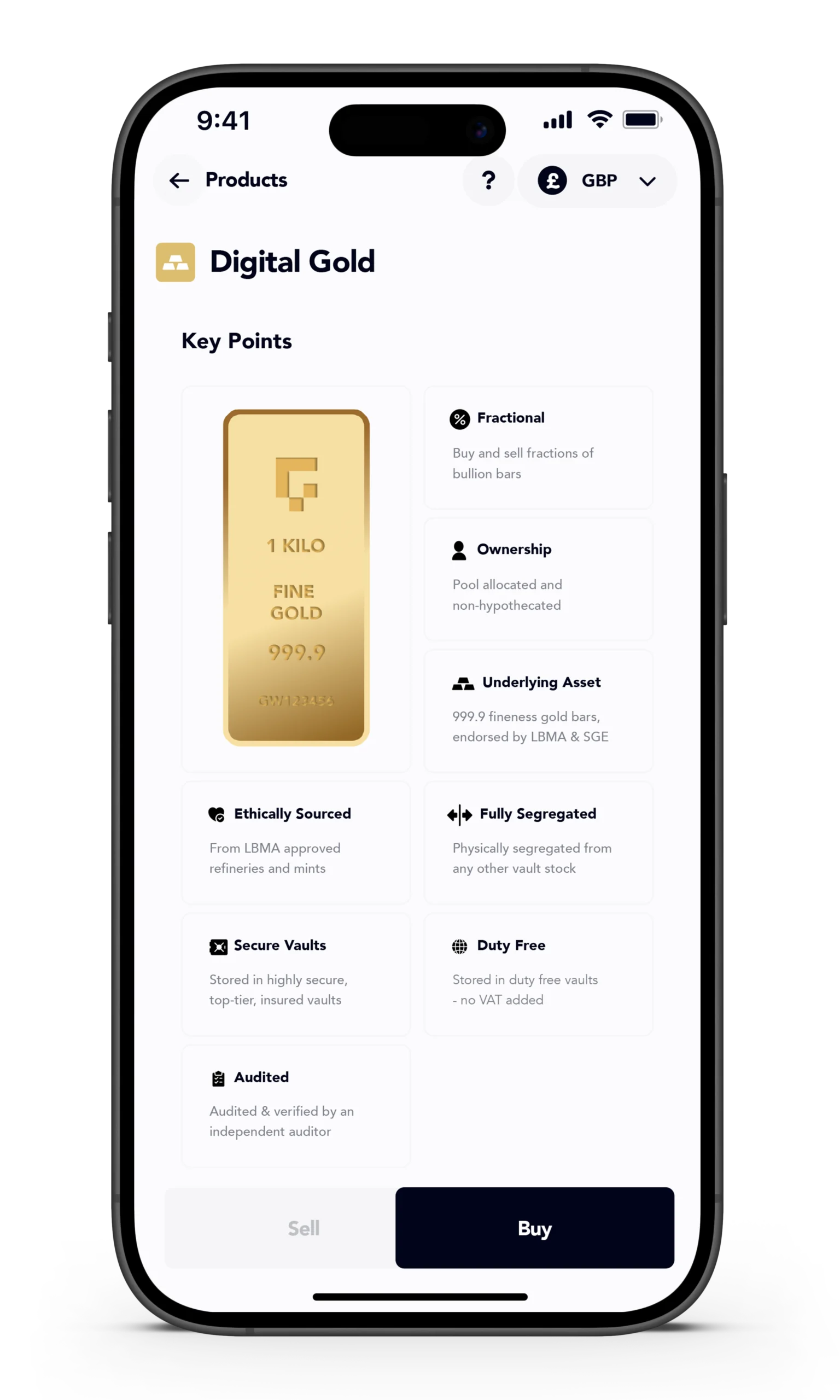

Select a Precious Metal

Having funded your account and started a Buy order, the first step is selecting the Precious Metal you want to trade

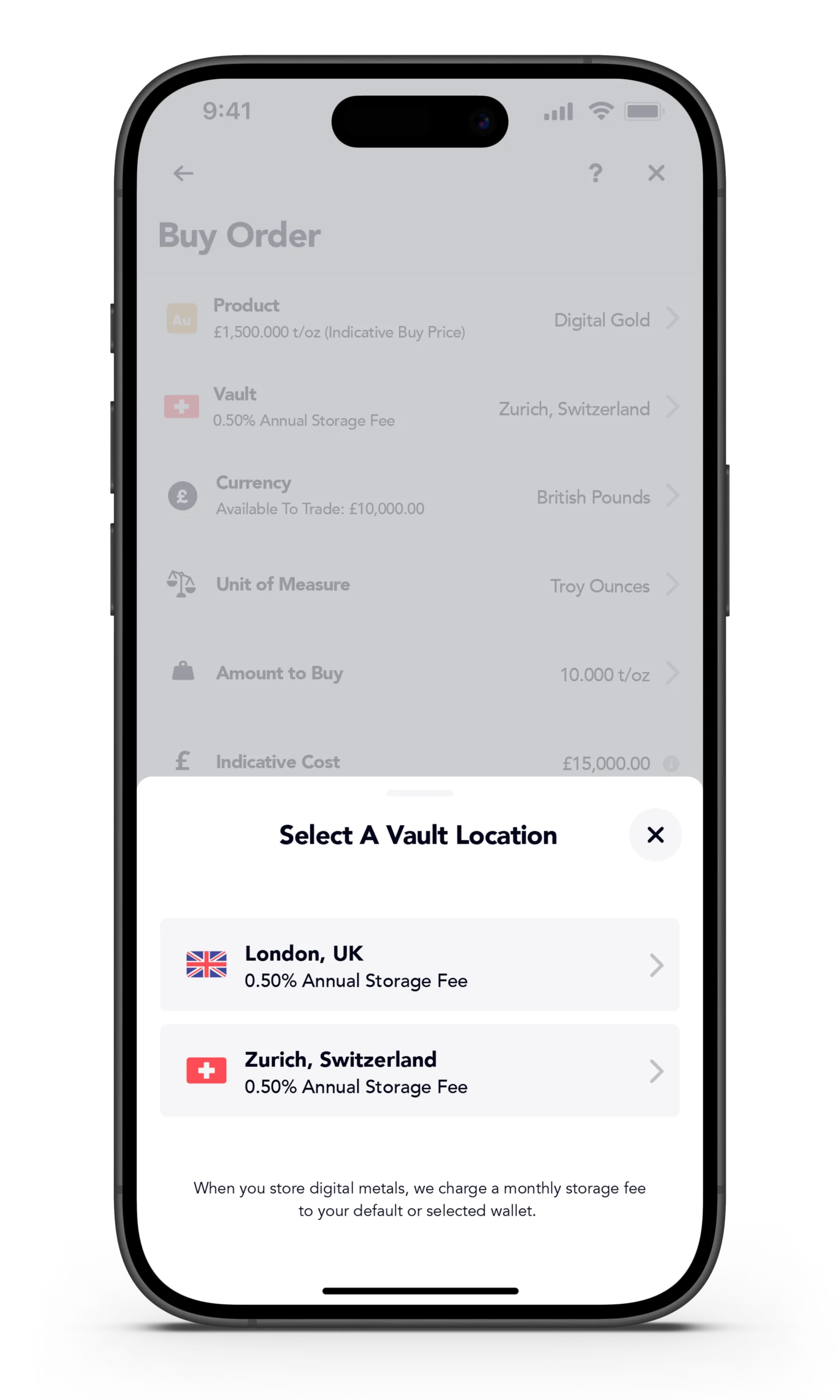

Select a Vault Location

Next, select which Vault location you want to store your precious metals in from our list of institutional vault partner locations

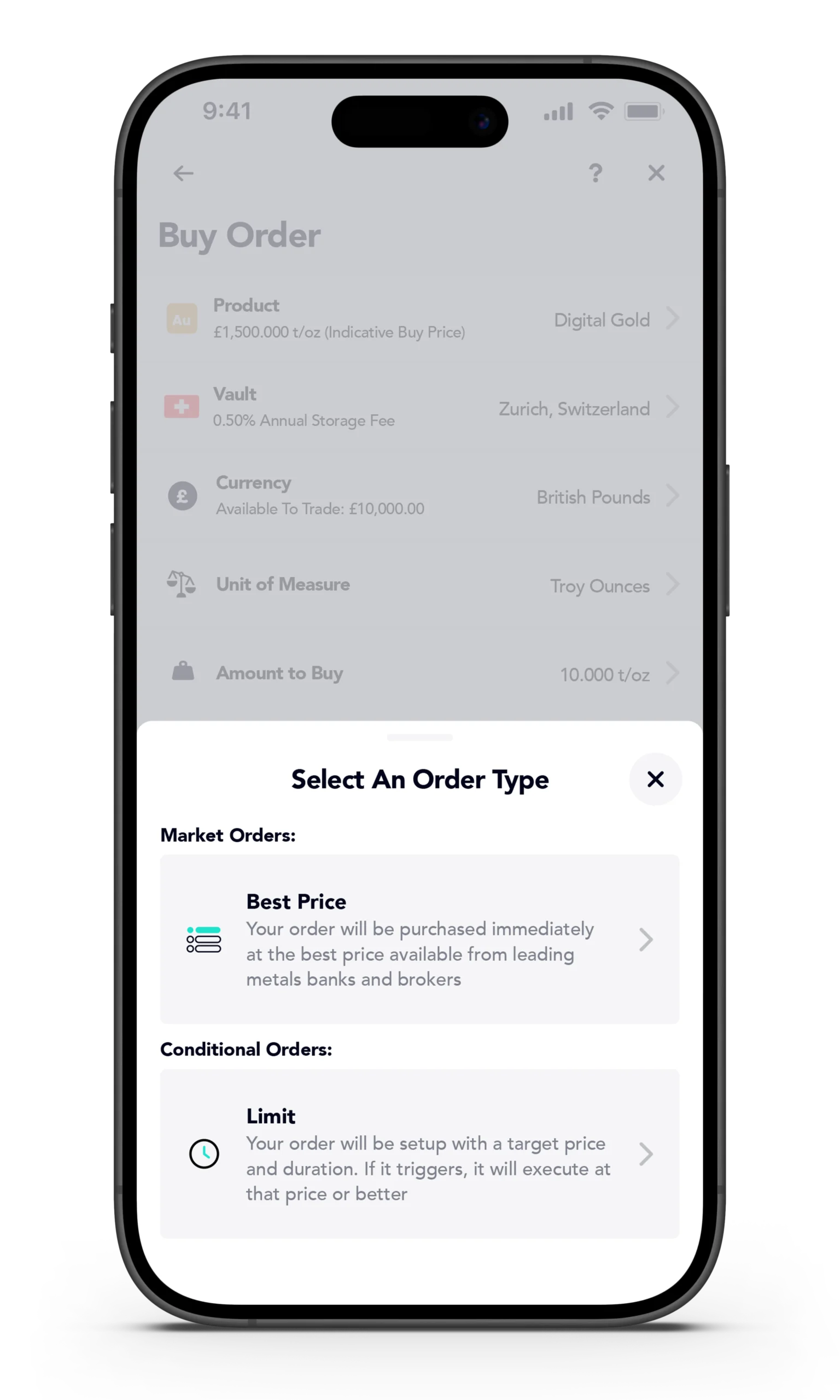

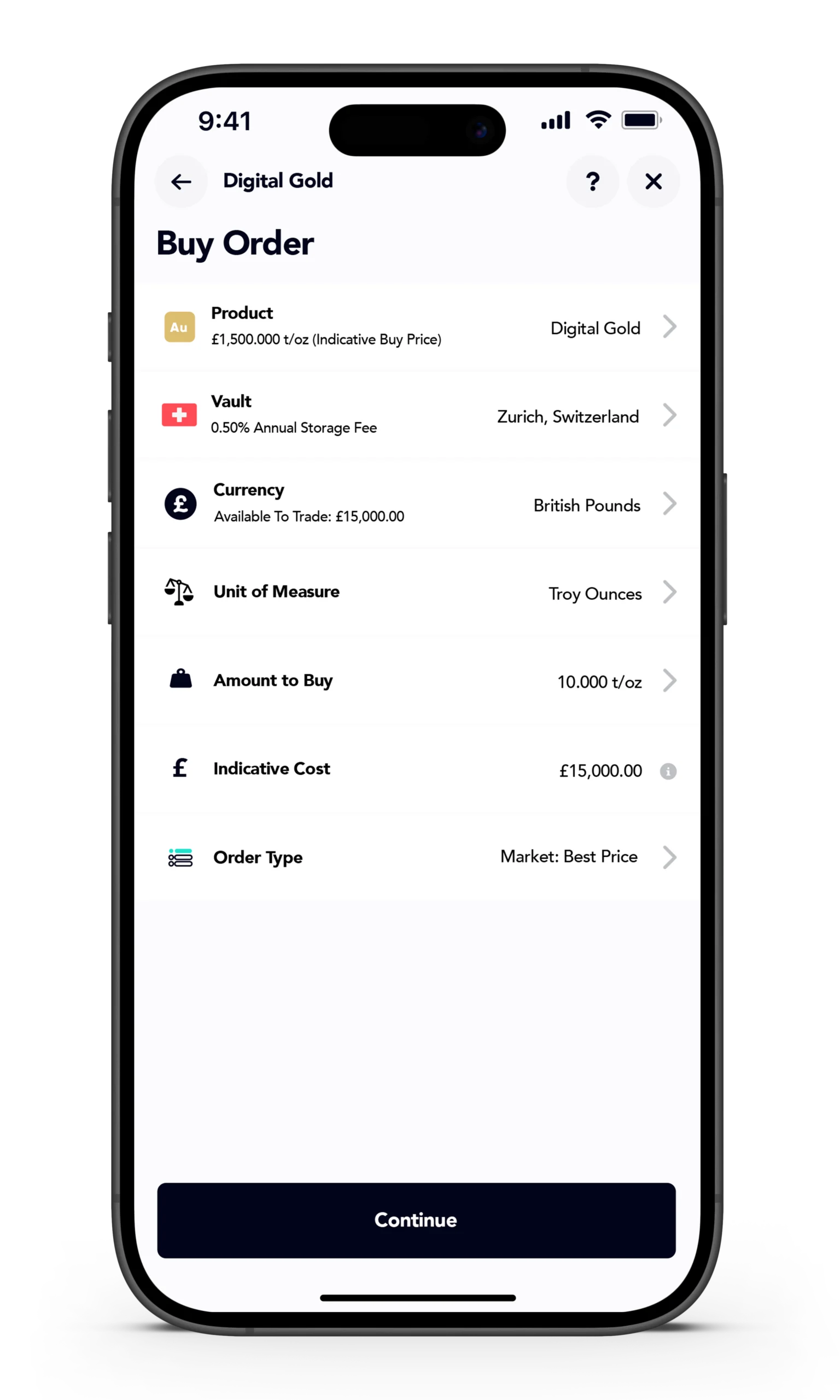

Enter your Order Criteria

Then, select the Currency to trade in, the Unit of Measure to use, the Amount to Buy or Sell and, the Order Type to use, choosing either to Buy now with Best Price or at a defined price with Conditional orders

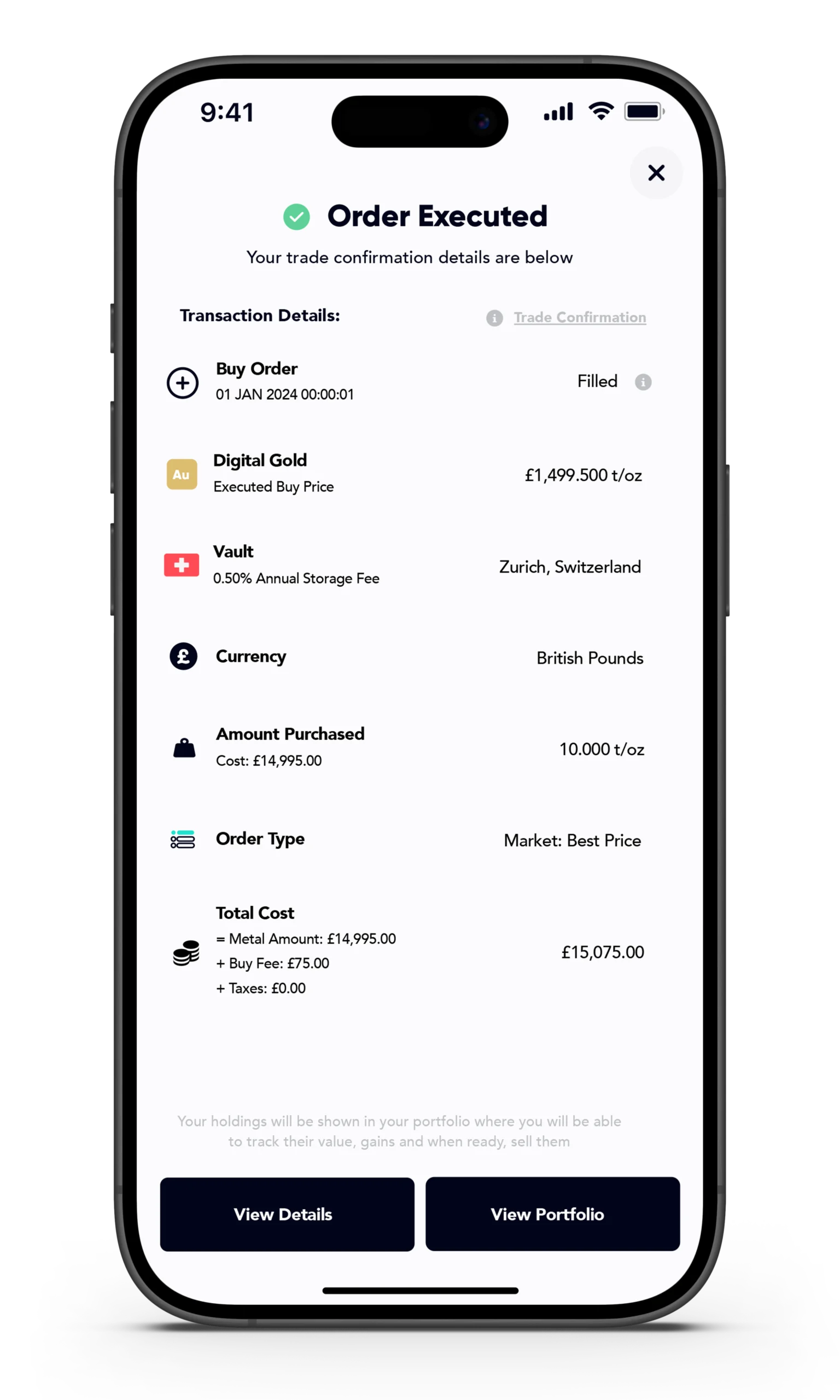

Review & Execute your Order

Review your Order details and costs and when ready, execute your order. Your Order will be Filled by the market based on your Order type & conditions

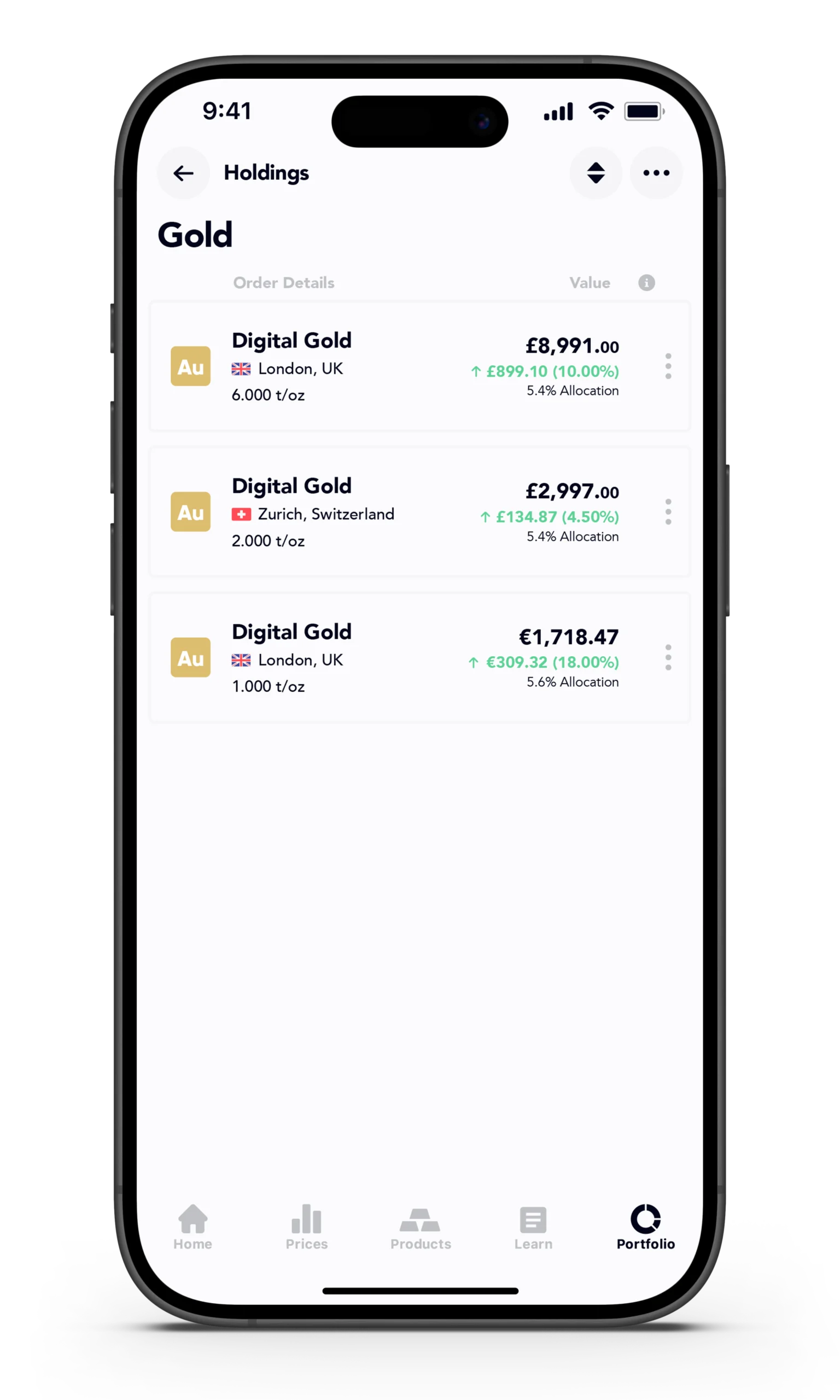

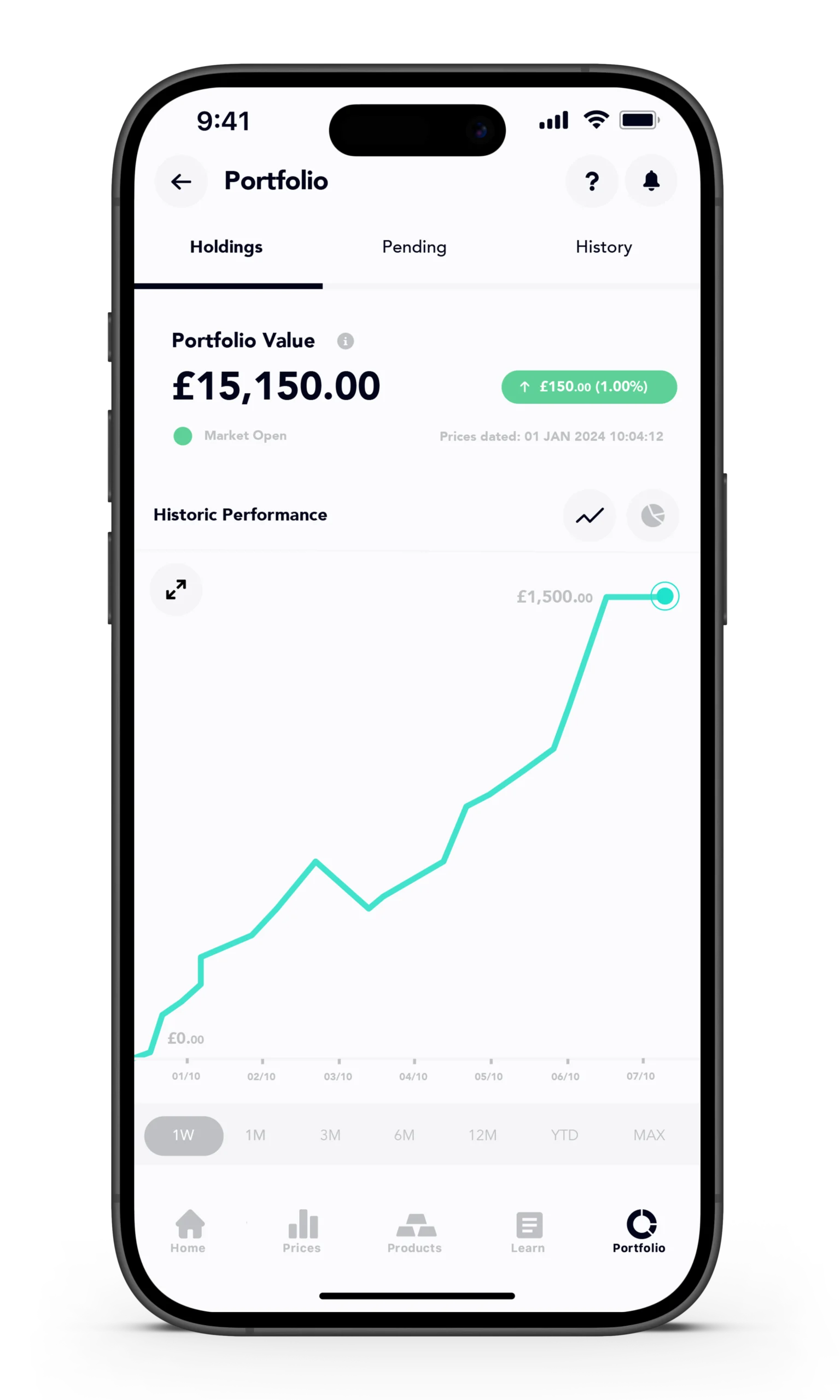

Manage your Portfolio & Sell

You'll finally be able to Track the real-time valuation and gains of your Order & Portfolio and when ready, choose to either sell immediately with Best price or on your conditions