INTRODUCING

Fractional Precious Metals Trading

Buy & Sell fractional amounts of ethically sourced, investment-grade bullion bars, produced by LBMA-approved refineries and stored in fully insured, independently audited, institutional-grade vaults.

PRODUCT DESCRIPTION

What are Fractional Bars?

The Problems With This Approach

Buying whole bars or coins can be unaffordable and inefficient — for several reasons:

- High Premiums: Smaller bars and coins carry significantly higher mark-ups, often 5–12% above spot, meaning you pay more upfront and lose more when selling.

- Poor Sell-Side Pricing: Dealers typically buy back at discounts of 2–8% below spot, creating total round-trip spreads that can exceed 10–20% for small products.

- Whole-Unit Selling Only: You must sell the entire coin or bar; you cannot liquidate small portions, which restricts flexibility and forces sub-optimal timing.

- Storage & Insurance Costs: Keeping metal at home requires proper security and often specialist insurance, while storing whole bars in vaults typically have higher fees.

- Shipping, Delays & Admin: Delivery comes with postage charges, waiting times, handling risks, and the hassle of packaging and returning items to sell.

- Counterfeit Risk: Popular bullion products are frequently counterfeited, requiring testing or verification when buying or selling, adding cost and inconvenience.

- Poor Fit for Regular Investing: Because you must buy whole units, it’s difficult to invest small amounts regularly - minimum purchase sizes are high and inflexible.

- Lack of Diversification: Buying whole items forces investors into fewer, larger positions, making it harder to diversify across metals or time their entries.

- Large-Bar Liquidity Issues: Bigger bars offer lower premiums but are difficult to sell; you must offload the entire bar at once, and some require assay or refining before resale.

- VAT on Non-Gold Products: Silver, platinum and palladium coins and bars incur 20% VAT in the UK when bought for delivery, instantly increasing the effective purchase cost for retail investors.

The Better Solution: Fractional Bars

Fractional Bars solve all of these problems. They provide a simple and cost-effective way to buy, manage and sell investment-grade physical bullion in fractional, affordable amounts — as small as 0.001 troy ounces — while benefiting from the efficiency of large institutional bars. Key benefits include:

- Low Premiums & Near-Spot Pricing: Fractional ownership lets investors access institutional bars, meaning pricing is much closer to spot with far lower mark-ups than small coins or bars.

- Sell Exactly What You Want: You can liquidate any amount—£50, £100, 0.01oz, 0.2oz—without being forced to sell a whole coin or entire bar.

- High Liquidity: Fractions can be traded instantly without physical handling, shipping delays, or waiting for dealers to assay and approve products.

- No Storage or Insurance Hassle: Vaulting, insurance and security are handled centrally at institutional-grade facilities, removing the risk and cost of home storage.

- No VAT: Because the metals remain in vaulted form and are not delivered, fractional holdings avoid the 20% VAT normally charged on silver, platinum & palladium metals.

- Lower Entry Point: Investors can start with very small amounts, making regular investing accessible and eliminating the need for large one-off purchases.

- Easier Diversification: Because you can buy in small increments, it’s simple to spread your holdings across multiple metals or purchase at different times.

- Allocated & Physically Backed: Fractions represent direct ownership of real LBMA bars, not synthetic products or credit balances, ensuring your metal is fully allocated and not pooled.

- Efficient for Frequent Trading: Low spreads and instant on-platform settlement make fractional bullion suitable for active buyers and sellers who value speed and execution quality.

- Transparent, Real-Time Pricing: Institutions provide live pricing directly from the wholesale markets, giving users clearer price discovery compared to retail dealer quotes.

KEY FEATURES

What you get

Fractional

Buy & Sell fractional amounts of bullion barsOwnership

Pool allocated & non-hypothecated with title ownershipPhysically Backed

Investment grade bullion bars endorsed by the LBMA & SGEEthically Sourced

Buy & Sell fractional amounts of bullion barsFully Segregated

Physically segregated from any other Vault stockSecure Vaults

Stored in highly secure, top-tier, insured vaultsDuty Free

Stored in duty free Vaults, no VAT addedAudited

Audited & verified by an independent auditorMore details about LBMA standards can be found here.

HOW IT WORKS

5 Easy Steps to Trade

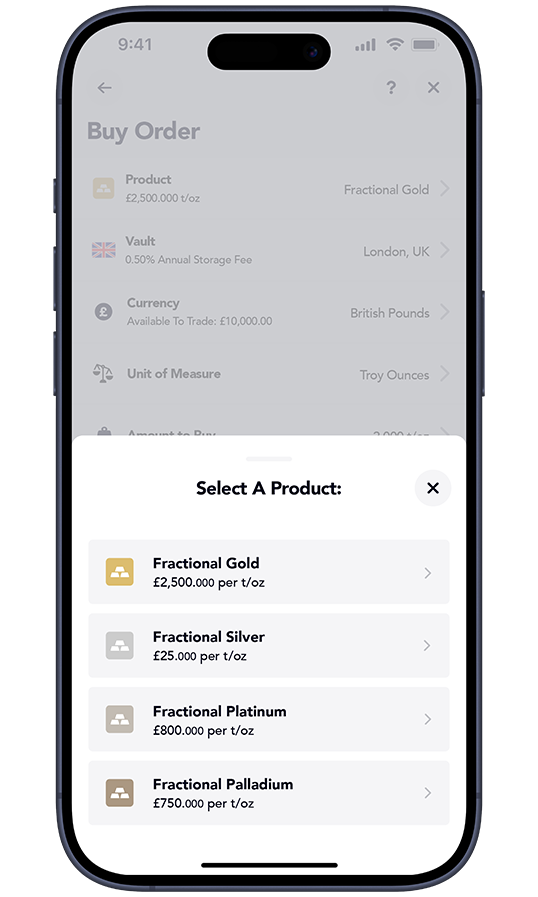

Select a Precious Metal

Having funded your account and started a Buy order, the first step is selecting the Precious Metal you want to trade

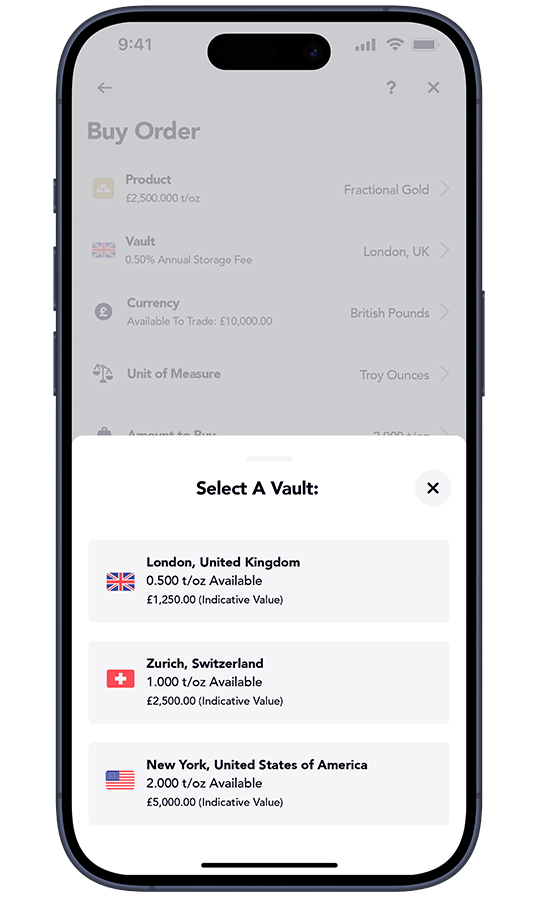

Select a Vault Location

Next, select which Vault location you want to store your precious metals in from our list of institutional vault partner locations

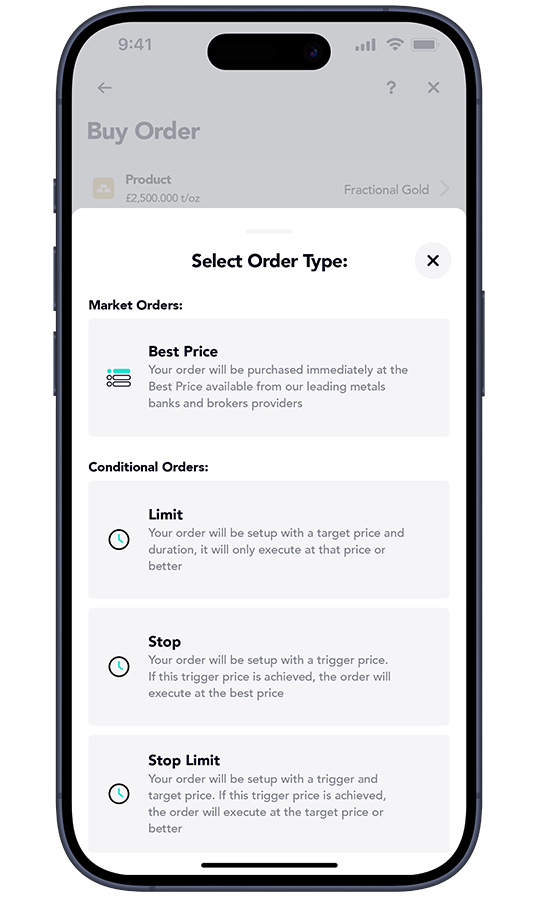

Enter your Order Criteria

Then, select the Currency to trade in, the Unit of Measure to use, the Amount to Buy or Sell and, the Order Type to use, choosing either to Buy now with Best Price or at a defined price with Conditional orders

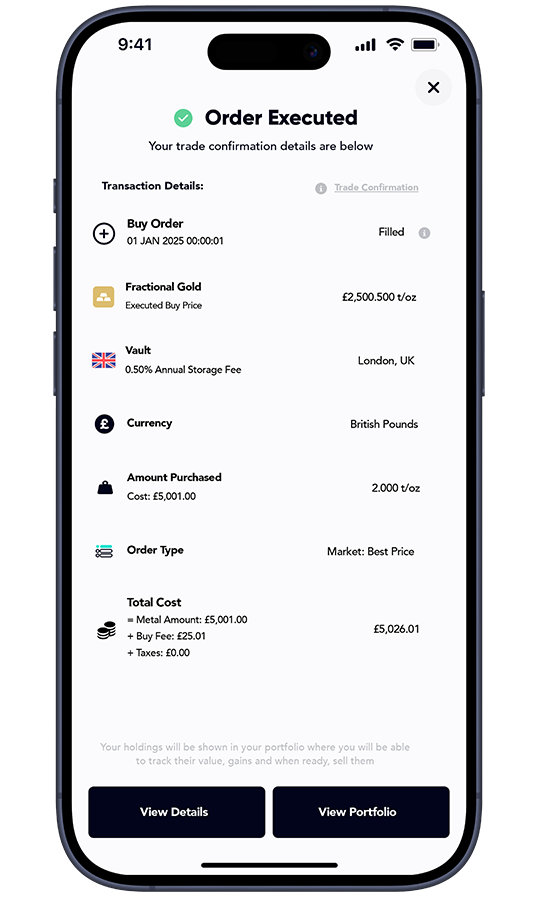

Review & Execute your Order

Review your Order details and costs and when ready, execute your order. Your Order will be Filled by the market based on your Order type & conditions

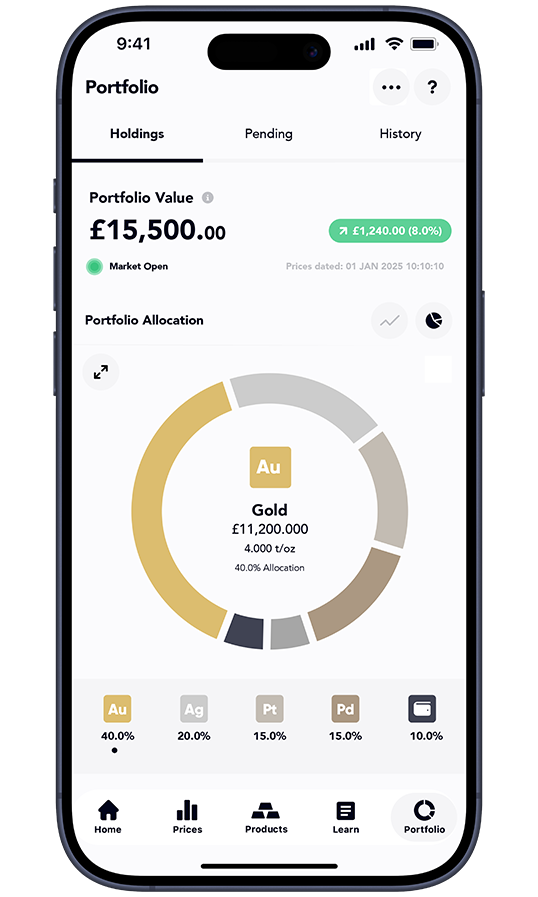

Manage your Portfolio & Sell

You'll finally be able to Track the real-time valuation and gains of your Order & Portfolio and when ready, choose to either sell immediately with Best price or on your conditions

GOLDWISE HELP & SUPPORT

Frequently Asked Questions

Find clear answers to the most common questions about Goldwise — from how to buy and sell precious metals to how your funds and assets are protected. Our FAQs cover everything from account setup, payments and vault storage to fees, taxes and trading hours, helping you get started and trade with confidence.

Is Goldwise regulated or authorised?

Goldwise partners with PayrNet Ltd, an FCA-authorised Electronic Money Institution, to safeguard customer funds under the UK’s Electronic Money Regulations 2011. All client funds are held in segregated safeguarded accounts.

Are my metals and funds safe?

Yes. Funds are safeguarded under UK regulation, and metals are fully allocated, insured and held in independent, audited vaults with Brink’s and Loomis. Customers always retain full legal title to their holdings.

How does Goldwise pricing work?

Goldwise connects directly to institutional metals markets to source live bid and ask prices from multiple global liquidity providers to give you the Best Prices on for your trades. We also offer low and transparent trading fees of 0.50% versus the typical 5–10% premiums charged by traditional bullion dealers.

Can I trade 24/7 on Goldwise?

Yes. The platform operates continuously, allowing customers to buy or sell gold, silver, platinum and palladium at live market prices any time of day, including weekends.

Can I sell my metals at any time?

Yes. Goldwise offers 24/7 trading in gold, silver, platinum and palladium. You can place instant market or conditional orders to buy or sell from your mobile app, with proceeds settled directly into your safeguarded wallet.

What types of orders can I place?

You can place instant market orders or conditional orders such as limit, stop and stop-limit. Orders can be set as “Good till Cancel” or “Good till Day”, giving you full control over execution strategy.

What are the fees for buying, selling and storage?

Trading fees start from 0.50% per transaction and storage from 0.15% per year, with transparent rates by metal and vault. View details on our Fees page.

How are my funds safeguarded?

All customer money is held in segregated safeguarded accounts through PayrNet Ltd under UK FCA rules. Funds are never co-mingled with company money and remain fully protected.

Where are my metals stored?

Metals are held in fully insured, third-party audited vaults across global locations such as London, Zurich and New York. You can view your allocated holdings and vault details in your account dashboard.

How do I open an account?

Simply download the Goldwise app, complete a trading application, add funds, and you can start trading fractional precious metals instantly.

Can I sell my metals instantly?

Yes. Sales execute at live market prices, with proceeds credited to your safeguarded wallet immediately. You can withdraw or reinvest anytime.

Does Goldwise provide investment advice?

No. Goldwise provides market access and educational content but does not offer financial or investment advice. Customers should make independent decisions or seek professional guidance.

View our Help Centre for more articles and Contact Details